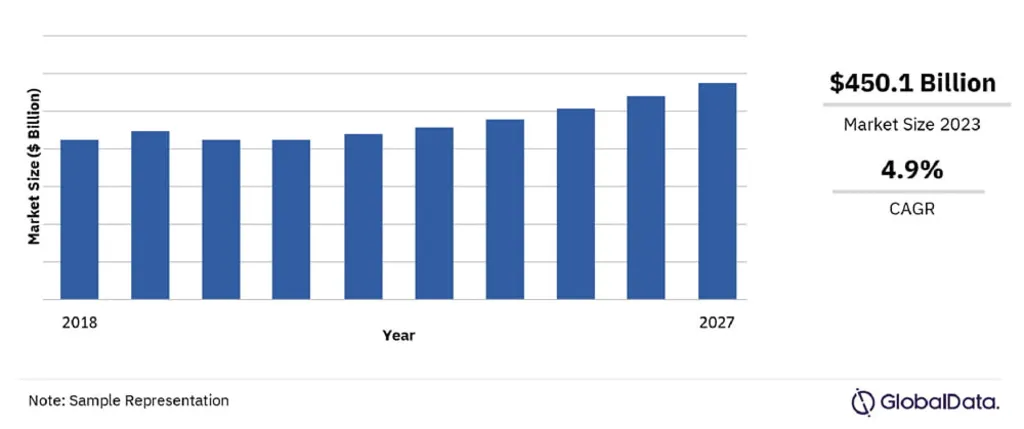

Southeast Asia is a rapidly developing region characterized by dynamic economic activities and significant growth potential. The construction sector in this region is expected to reach $450.1 billion in 2023, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. To navigate the complexities of the regional construction market effectively, stakeholders such as investors, developers, and policymakers may find it beneficial to seek insights and strategic guidance from expert SEA construction consulting services.

In this article, we will take you through an in-depth analysis of the SEA infrastructure market outlook and provide a detailed sectoral breakdown, offering a comprehensive understanding of where this market is headed and the opportunities it presents.

SEA Construction Market Forecast and Overview

The increasing focus on developing regional connectivity through transport infrastructure is anticipated to drive SEA construction market growth in the near future. In 2023, the infrastructure construction sector is projected to expand by 4.8% in real terms. A notable example of this growth is the Philippines Department of Transportation (DOTr) awarding contracts worth PHP52.2 billion ($937 million) to major joint ventures for the North-South Commuter Railway (NSCR) project in April 2023.

Research from GlobalData forecasts a 3.1% growth in the regional construction industry in 2023, with an expected annual average growth rate (AAGR) of 6.2% from 2024 to 2027. This outlook is supported by expansions in infrastructure and commercial sectors aimed at boosting tourism. The Malaysian government, for example, aims to attract 16.1 million international tourists in 2023, targeting MYR49.2 billion ($11.2 billion) in tourist receipts.

Sectoral Insights of the SEA Construction Market

- Residential Construction: Despite challenges like rising inflation and borrowing costs, this sector is expected to rebound in 2024 with new housing initiatives, including Indonesia’s plan to build five million housing units by 2027 through public-private partnerships.

- Institutional Construction: Although predicted to have the smallest share in 2023, this sector will still grow by 4.9% in real terms, driven by investments in healthcare and education. Singapore’s 2023 budget, for instance, increased healthcare development expenditure by 24.7%, totaling SGD1.4 billion ($1 billion).

- Infrastructure Construction: Forecast to hold the largest share in 2023, Indonesia is prioritizing the completion of key infrastructure projects, including roads, airports, and railways, under President Joko Widodo’s current administration.

- Industrial and Energy Construction: These sectors anticipate similar growth rates, supported by public and private investments. Notably, the Philippines is advancing its renewable energy goals, planning to increase renewable energy to 50% of its power generation mix by 2040.

- Commercial Construction: Expected to grow by 2.5% in 2023, with investments in tourism and data center projects like the 96MW Princeton Digital Group campus in Indonesia.

SEA Infrastructure Regional Dynamics

Indonesia leads the regional construction market, accounting for 51.0% in real terms in 2023, though growth has slowed due to elevated material costs and a cooling commercial property market. Conversely, Vietnam continues to attract significant foreign direct investment, buoyed by its improving business climate. The Philippines plans robust growth in housing and infrastructure, aiming to construct one million units annually from 2023 to 2028.

Overall, the Southeast Asia construction market is dynamic, driven by strategic regional investments and a diverse array of sectoral developments, setting the stage for substantial growth and transformation in the coming years. Navigating this market can be challenging; however, collaborating with experts such as SEA construction consulting services can effectively address these challenges. Such partnerships help ensure projects align with broader economic goals, contributing to the growth of the region’s construction sector.