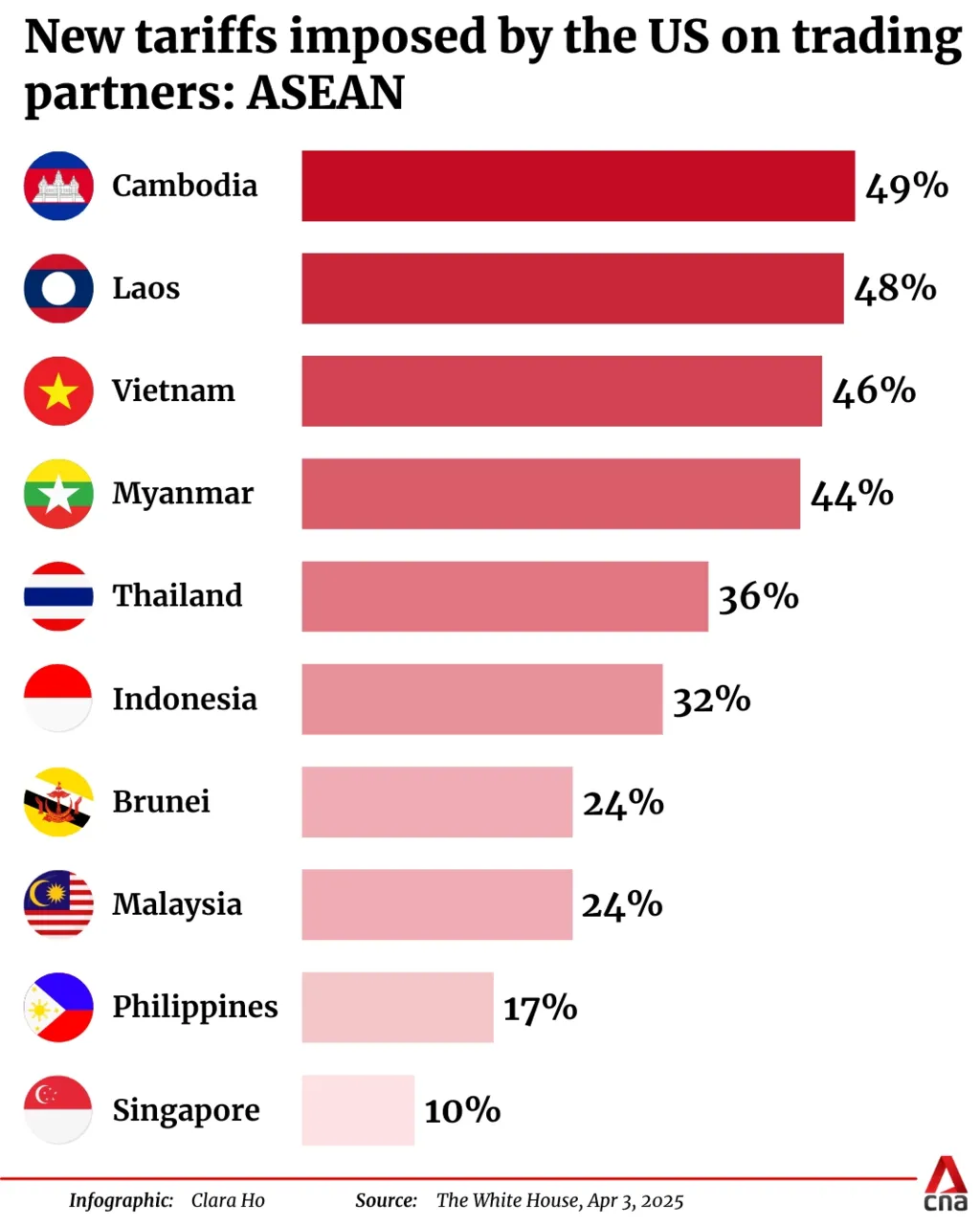

The Southeast Asia Tariff Supply Shift is reshaping the region’s trade and manufacturing dynamics. In 2025, US tariff rates on Southeast Asian goods are substantial: Indonesia faces a 32% tariff, Thailand 36%, and Malaysia 25% on key products like semiconductors and electronics. These tariffs range from 10% to as high as 49%, hitting major sectors such as automotive, steel, and aluminum.

Despite these pressures, Southeast Asia’s collective economy, valued at $3.8 trillion, continues to adapt. Vietnam remains resilient, while other economies recalibrate growth expectations in response to changing global trade dynamics.

Chinese Export Declines Drive New Opportunities

As US tariff pressures mount on China, American buyers have started sourcing elsewhere. In Q2 2025, demand for inspections and audits in China fell by 24% year-over-year. Meanwhile, demand in Southeast Asia’s major supplier markets increased by 29%. This sharp contrast highlights a significant Southeast Asia Tariff Supply Shift, as buyers pivot supply chains to avoid tariff impacts and ensure business continuity.

Between January and April 2025, containerized export volumes from China to the US fell by 23.6%. In contrast, Southeast Asian exports to the US rose steadily, benefiting countries like Vietnam, Malaysia, Indonesia, and the Philippines. Vietnam’s electronics sector and Thailand’s automotive industry, in particular, have seen rapid growth as alternative supply bases to China.

Sector-Specific Growth Across Southeast Asia Tariff Supply Shift

The tariff shift is more than just a temporary adjustment. It can be said that it is reshaping sector-specific production hubs. Vietnam has emerged as a leading destination for electronics manufacturing, while Malaysia is strengthening its role in semiconductor production. Thailand is boosting its automotive manufacturing capacity, and Indonesia is attracting investments in automotive-related supply chains.

These shifts align with the region’s strong economic partnerships and proximity to China, making Southeast Asia an ideal pivot point for global manufacturers seeking to diversify. The suspension of the US de minimis rule and rising tariffs have further fueled this momentum, pushing businesses to redesign supply chains and minimize cost risks.

Adaptation Through Logistics and Infrastructure

To absorb redirected exports efficiently, Southeast Asia is investing in multimodal transport solutions and modernizing logistics infrastructure. Countries are expanding port capacity, enhancing rail networks, and streamlining customs procedures to handle higher trade volumes.

This proactive adaptation reflects the region’s commitment to becoming a critical global trade hub. The Southeast Asia Tariff Supply Shift has also triggered a surge in cross-border collaborations, with governments and private players working together to overcome infrastructure bottlenecks.

Read Also: Southeast Asia Cross-Border Trade Goes Digital

A Long-Term Structural: Southeast Asia Tariff Supply Shift

The Southeast Asia Tariff Supply Shift represents a multi-year realignment of global supply chains rather than a short-term response. Since mid-2023, Southeast Asia’s share in US sourcing has consistently grown, signaling deeper structural changes.

This trend highlights the strategic importance of Southeast Asia in future global trade flows. By absorbing redirected Chinese exports and strengthening its industrial base, the region is positioning itself as a reliable alternative in a world increasingly defined by trade tensions and shifting alliances.

Southeast Asia’s ability to capitalize on the Southeast Asia Tariff Supply Shift demonstrates its growing resilience and adaptability. Through sector-specific investments, logistics upgrades, and strategic partnerships, the region is not just absorbing supply. In fact, it is transforming into a new global manufacturing powerhouse.

Read Also: Southeast Asia Foreign Equity Inflows Breakthrough