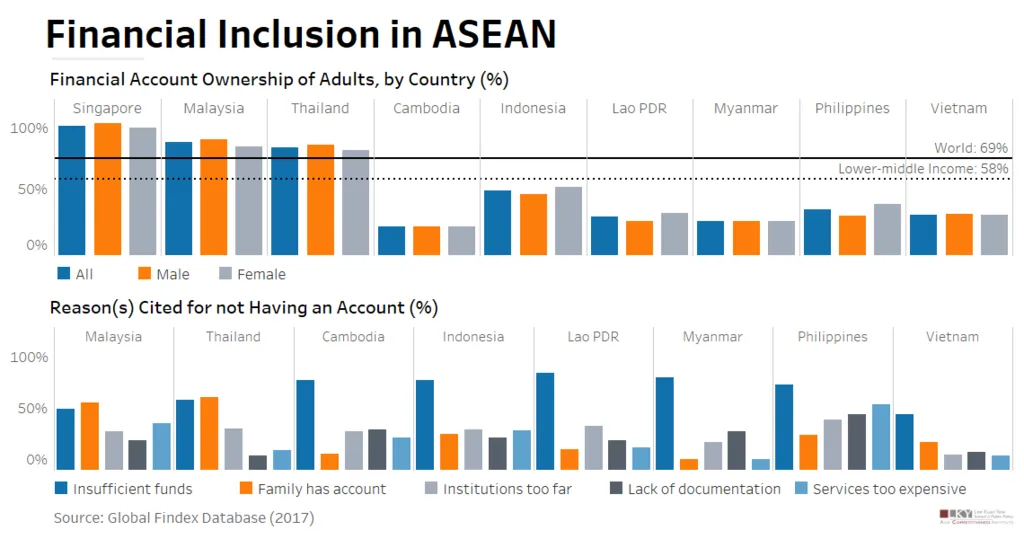

ASEAN has made big strides in banking access. Between 2017 and 2022, the region cut its financial exclusion rate from 46% to 22.62% of adults. Yet 166 million adults, or about 24.1% of the population, remain unbanked, missing formal financial services. Account penetration varies widely, ranging from 33% to 96%, highlighting both progress and persistent gaps in financial inclusion ASEAN.

Fintech Growth: A $1.7 Trillion Opportunity

Digital finance in Southeast Asia is booming fast. Fintech payments are expected to surge with a compound annual growth rate (CAGR) of 19.8% from 2024 to 2029, potentially reaching USD 1.7 trillion in transaction value. With 85% of adults still underbanked (~300 million people), fintech providers have a massive market to serve.

Small businesses are also hungry for innovation. MSMEs make up over 97% of ASEAN businesses but face a $300 billion formal credit gap. This gap offers fintech firms a critical way to boost financial inclusion ASEAN through loan platforms and trade finance tools.

Read Also: Super-Apps and Southeast Asia Fintech Innovations are Rising Fast

Mobile Banking Drives Financial Inclusion ASEAN, But Unevenly

Fintech and mobile wallets are shifting how people access money. In Indonesia, the unbanked rate fell from 51% in 2017 to 14.9% in 2022, thanks to mobile-first banking services. Yet in countries like Laos, over 70% of adults remain unbanked despite 88.5% mobile penetration. This mismatch shows that access alone is not enough—actual usage matters for true financial inclusion ASEAN.

Regional Initiatives Fuel Integration

Major digital finance initiatives are under way. The ASEAN Digital Economy Framework Agreement (DEFA) aims to double the region’s digital economy—from $1 trillion to $2 trillion by 2030. Meanwhile, the Regional Payment Connectivity Initiative is unifying cross-border QR payment systems.

Retail response has been strong. Over 85% of merchants in Thailand, Vietnam, and Indonesia now accept QR payments. These trends help drive financial inclusion ASEAN, especially in rural and underserved markets.

Regulation and Cybersecurity Loom Large

Rapid growth brings risk. Regulatory uncertainty makes businesses cautious, especially around cybersecurity. Yet, effective governance, including board-level oversight and security committees, significantly boosts trust and performance.

ASEAN countries are working toward unified cybersecurity rules, recognizing that protecting data and systems is essential for scaling fintech and ensuring financial inclusion ASEAN remains safe and sustainable.

Financial Inclusion ASEAN: Fintech Investment and Startup Hotspots

Fintech is not just fast-growing, but it is also attracting capital. In 2024, Singapore alone raised USD 955 million in fintech funding, followed by Jakarta ($242 million) and Bangkok ($198M). Overall investment in ASEAN fintech has more than 10x over the past decade.

Top investors include East Ventures, Y Combinator, and 500 Global, all placing big bets on platforms that promise deeper financial inclusion ASEAN.

Upskilling and Workforce Digital Readiness

ASEAN leaders have pledged to upskill 20 million citizens in digital and AI skills by 2030. Programs in Singapore and Malaysia, and emerging academy networks, have driven a 250% jump in regional AI proficiency since 2020. Skilled workers are vital to designing and operating fintech systems that support financial inclusion.

The Time for Financial Inclusion ASEAN Is Now

Southeast Asia is at a crossroads. With over 300 million underbanked adults, rising fintech use, and booming digital finance investment, the region can unlock inclusive growth. But success depends on smart regulation, cybersecurity, and strong investment in skills and infrastructure. When aligned, these elements can reshape the financial landscape—and make true financial inclusion ASEAN a reality.

Read Also: Uniting for Economic Change: Southeast Asia Green Finance