The fintech revolution in Southeast Asia is no longer emerging, but exploding. Since 2000, the number of fintech ventures in the region has soared by 3,588%, reshaping how people access money, credit, and digital services. From e-wallets to super-apps, Southeast Asia fintech innovations are changing lives. Not to mention that it is also building one of the world’s most dynamic financial ecosystems. Let's take a look!

Southeast Asia Fintech Innovations: A Rapidly Expanding Market

The pace of growth is staggering. Fintech investments in ASEAN’s six largest economies jumped from 2% of total investments in 2018 to 7% in 2022. Even more impressive is the projected US$1.7 trillion in fintech transaction value by 2029, growing at a compound annual growth rate (CAGR) of 19.8% from 2024 onward.

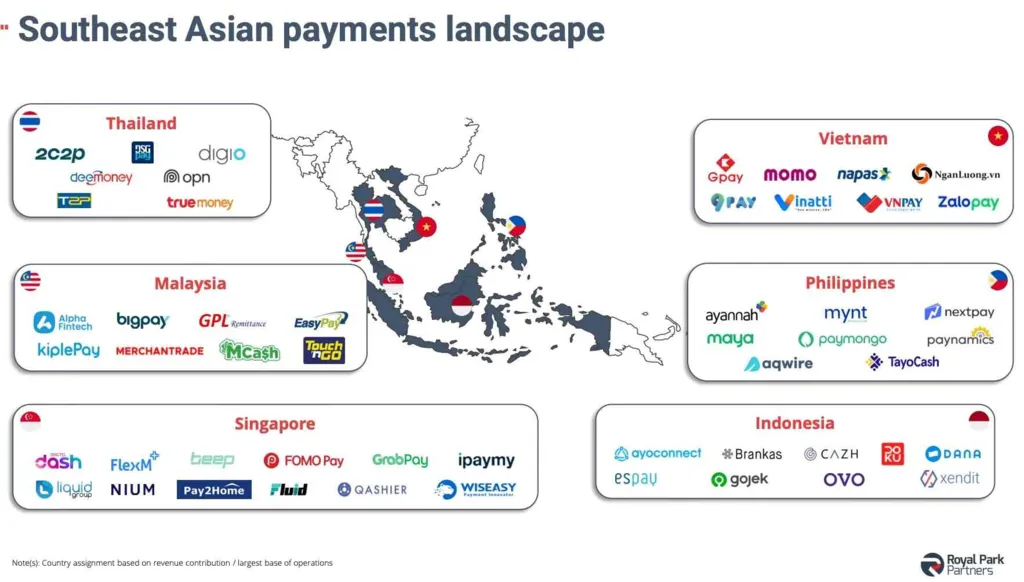

Much of this growth is fueled by rising demand for digital payments. In 2023 alone, transaction volumes surpassed US$13 billion, with more than 85% of retailers in Indonesia, Thailand, and Vietnam accepting QR code payments.

Read Also: Southeast Asia Digital Transformation Accelerates Fast in the Region

Financial Inclusion is Fintech’s Mission

When thinking about Fintech, what comes to mind? Convenience, yes, but also access. In Southeast Asia, 85% of adults—around 300 million people—are still underbanked. Many have no access to traditional banks, credit cards, or loans. At the same time, 97% of the region’s businesses are micro, small, or medium-sized enterprises (MSMEs), and they face a US$300 billion credit gap.

Traditional banking systems have struggled to meet their needs. But fintech lending platforms are stepping in, offering quicker, more flexible access to capital. In Q1 2025 alone, alternative lending fintechs raised $34.6 million, showing that even amid funding slowdowns, the appetite to solve these issues remains strong.

The Power of Super-Apps in Southeast Asia Fintech Innovations

One of the standout trends in Southeast Asia is the rise of super-apps or platforms that combine ride-hailing, shopping, payments, and financial services in one interface. Apps like Grab, Gojek, and Shopee now boast a combined user base of around 310 million people.

These platforms are not only convenient but transformative. By embedding digital wallets, loans, and insurance into apps already used daily, super-apps make financial tools accessible to a broader population, especially in rural or underserved areas.

The Youth and the Middle Class Are Driving Demand

Southeast Asia’s population is young and increasingly digital. People aged 15–34 make up over a third of the region’s population, and the middle class is growing by 5% each year through 2030. This demographic is tech-savvy, mobile-first, and hungry for digital-first financial solutions.

They don’t want to wait in lines or navigate complex bank processes. They want instant credit checks, contactless payments, and investment tools at their fingertips. Fintech innovations are rising to meet this demand, delivering intuitive platforms tailored to modern lifestyles.

Read Also: The Bold Rise of Cambodia Digital Economy Growth Today

Southeast Asia Fintech Innovations: Innovation with Impact

Southeast Asia fintech innovations are solving real problems. With millions underbanked and small businesses left behind by traditional finance, fintech offers a bridge to inclusion, empowerment, and economic resilience. From QR payments to super-apps, and from microloans to mobile wallets, the fintech boom in Southeast Asia is talking about access, equity, and opportunity. And with a US$1.7 trillion market in sight, the journey has only just begun.