ASEAN QR payment interoperability is changing how people spend money across Southeast Asia.

Tourists from Thailand, Malaysia, Singapore, and Indonesia can now scan a QR code and pay instantly using their local apps. No cash. No card. No currency exchange counter.

In 2024 alone, travelers from these four countries made 120 million cross-border QR payments, a jump of 200% from 2022. This simple change is having a powerful effect on tourism and small businesses across the region.

A Seamless Experience for Tourists and SMEs

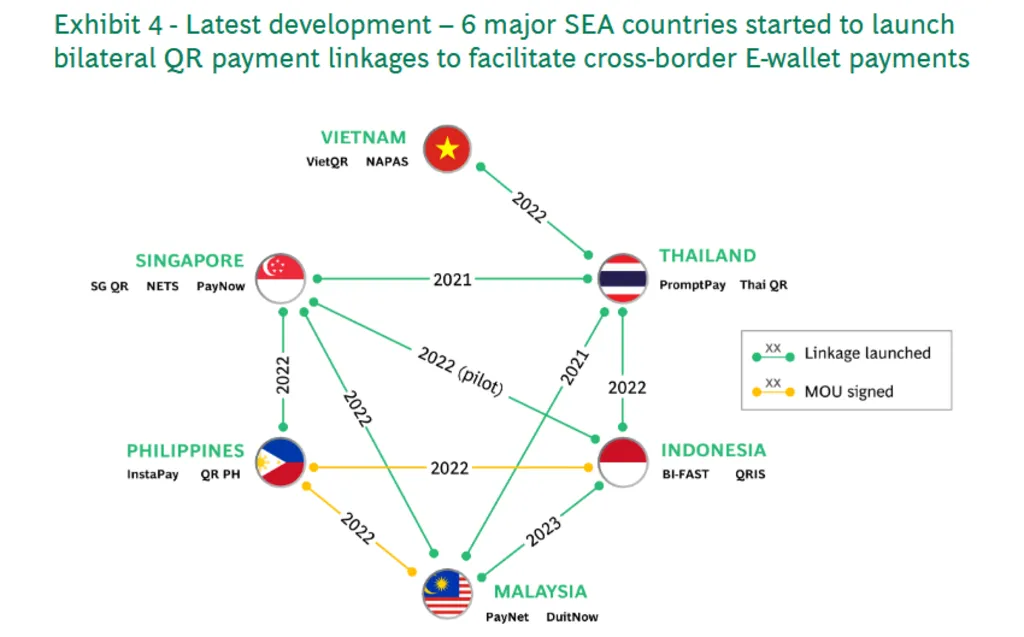

The system connects national QR platforms such as Thailand’s PromptPay, Indonesia’s QRIS, and Singapore’s SGQR+. Launched gradually since 2017, the network now links eight ASEAN countries as of 2025.

For tourists, the benefit is speed and clarity. They pay in local currency, see prices clearly, and avoid exchange fees. Currency exchange needs dropped by 60% for travelers using QR.

For small merchants, the impact is direct. SME tourism spending rose 35% in participating countries. Local shops earned 25% more from regional visitors. In total, this frictionless payment flow lifted SME revenues by $2.5 billion.

ASEAN QR Payment Interoperability Feels Like One Currency

Cross-border QR payments grew 250% year over year in 2024. Transaction volumes reached $10 billion equivalent by 2025.

This behavior mirrors a shared currency system. Many now call it the “ASEAN Dollar” effect. People spend across borders as if they never left home. FX fees are minimized. Local currencies are used instead of the US dollar.

In linked countries, 70% of tourists now use QR payments, cutting cash usage by 50%. This shift is reshaping daily commerce, especially in tourist-heavy areas.

Read Also: Southeast Asia Video Commerce & The Shoppertainment Revolution

ASEAN QR Payment Interoperability Is the Proven Growth Across Key ASEAN Corridors

The results are measurable. When Thailand and Malaysia linked their QR systems in 2021, cross-border QR transactions jumped 300% in the first year.

Indonesia’s QRIS linkages with Thailand and Singapore saw a 150% rise in tourist payments in 2023.

Across ASEAN, QR linkages processed over 500 million transactions in 2024, reducing payment costs by up to 40% compared to card networks.

Project Nexus and the Challenge to Card Networks

Behind this momentum is Project Nexus, launched in 2024. It connects six central banks and already handles 1 billion transactions annually.

This matters because it challenges Visa and Mastercard, which once controlled 80% of regional payments. By mid-2025, the QR ecosystem captured 45% of ASEAN’s digital payments market.

Banks and e-wallets report a 20% shift from cards to QR in Nexus countries. Near-zero transaction costs are replacing card fees of 2-3%. The balance of power is changing.

Read Also: Gulf Investors Are Reshaping Southeast Asia M&A Infrastructure Focus

Looking Ahead With ASEAN QR Payment Interoperability

ASEAN QR payment interoperability is no longer just a payment upgrade. It is a regional economic tool that boosts tourism, strengthens SMEs, and reduces dependence on global card networks. To understand how this shift affects market entry, consumer behavior, and financial ecosystems, organizations can explore more services from Market Research Southeast Asia by Eurogroup Consulting. With 40 years of distinguished experience, Eurogroup Consulting excels in consumer strategic consulting and market research across ASEAN, helping clients succeed in the region’s rapidly evolving market landscape.