Southeast Asia is attracting unprecedented investor attention. In a major turning point, the region recorded its largest monthly foreign equity inflows in 15 months—over $10.6 billion—breathing new life into capital markets and signaling renewed global confidence. This surge in investment is part of a larger, longer-term trend. In 2023, foreign direct investment (FDI) into ASEAN hit a record $230 billion, despite global headwinds. This figure marks a steady rise from the average $170 billion annually since 2016, and a significant leap from the $92 billion average between 2006 and 2015.

Perhaps most impressively, ASEAN’s share of global FDI climbed to 17% in 2023, nearly tripling the 6% average a decade earlier. This underlines how the Southeast Asia foreign equity inflows story is about more than short-term gains, but also a region stepping into a larger role on the world stage.

Southeast Asia Foreign Equity Inflows: What's Driving This Momentum?

One major catalyst has been policy reform. The ASEAN Economic Community (AEC) Blueprint 2025 has strengthened investment climates across the region by improving regulatory transparency, integration, and policy consistency. These shifts make it easier for foreign capital to enter and stay.

At the same time, investors are following the money into future-focused sectors. Capital is flowing into renewable energy, digital infrastructure, electric vehicle supply chains, and smart manufacturing. These areas align with global trends and sustainability goals, giving ASEAN a long-term competitive edge.

Read Also: Why Infrastructure Investment Opportunities Are Surging in SE Asia

Capital Markets Feel the Lift

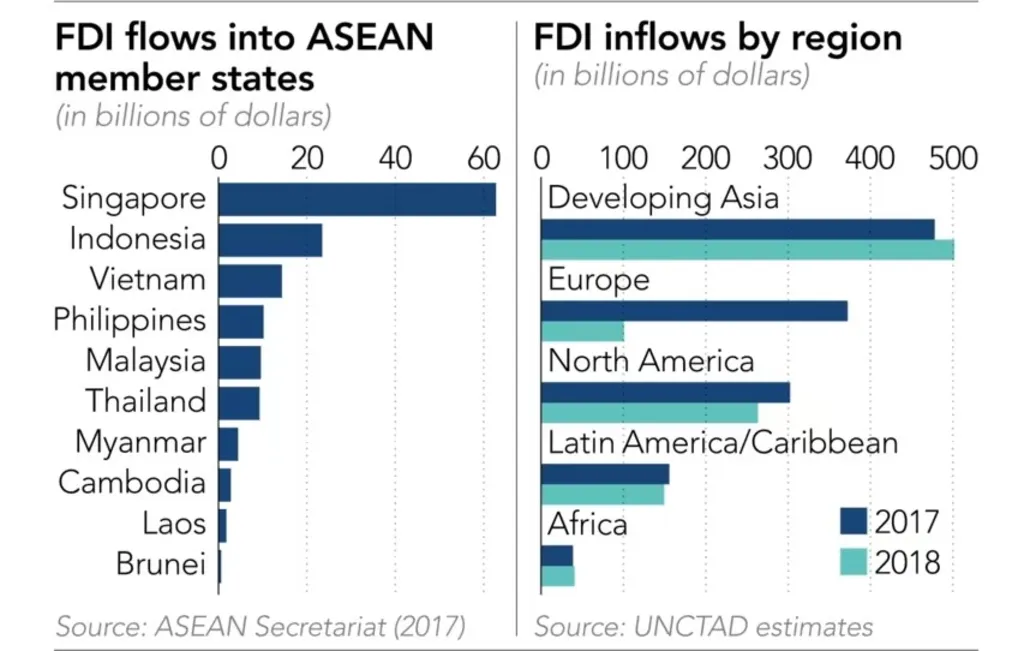

The capital markets are reflecting this inflow of energy. From $2.8 trillion in 2023, ASEAN’s market capitalization rose to $3.0 trillion by the end of 2024, driven by equity market performance in key economies like Indonesia, Vietnam, Malaysia, Thailand, and Singapore.

These markets are benefiting from positive economic projections heading into 2025. Stable growth, young populations, and digital adoption are keeping Southeast Asia high on global investor watchlists.

The $10.6 billion inflow spike isn’t a blip. It’s part of a broader shift toward long-term positioning in ASEAN economies. With capital returning and market performance strengthening, regional equity is becoming more attractive, particularly compared to more volatile or overvalued developed markets.

Southeast Asia Foreign Equity Inflows: Confidence Meets Opportunity

As the world diversifies away from traditional financial hubs, Southeast Asia stands out for its resilience, reform, and relevance. The scale of Southeast Asia foreign equity inflows highlights not just investor enthusiasm, but also confidence in ASEAN’s future-readiness.

With investment inflows averaging $220 billion annually from 2021 to 2023, and emerging industries poised to scale, the region’s outlook is strong. Initiatives like deeper integration under AEC 2025, and national plans for green and digital transformation, add further weight to the investment case.

Read Also: Unlocking Southeast Asia Business Insights for Investors

A Turning Point for ASEAN Markets: Southeast Asia Foreign Equity Inflows

The surge in Southeast Asia foreign equity inflows marks a defining moment for the region. Record-breaking investments, improving policy landscapes, and sectoral shifts are aligning to make ASEAN a key destination for smart capital. For global investors looking for growth, stability, and future-ready sectors, Southeast Asia isn’t just promising—it’s already delivering.