Global investment in quantum computing is accelerating fast, and Southeast Asia is stepping up as a rising powerhouse in this revolutionary sector. The region is experiencing what many call a Southeast Asia Quantum Funding Surge, backed by strong government strategies and enthusiastic private sector support. Let's take a look!

Southeast Asia Quantum Funding Surge Sets the Stage

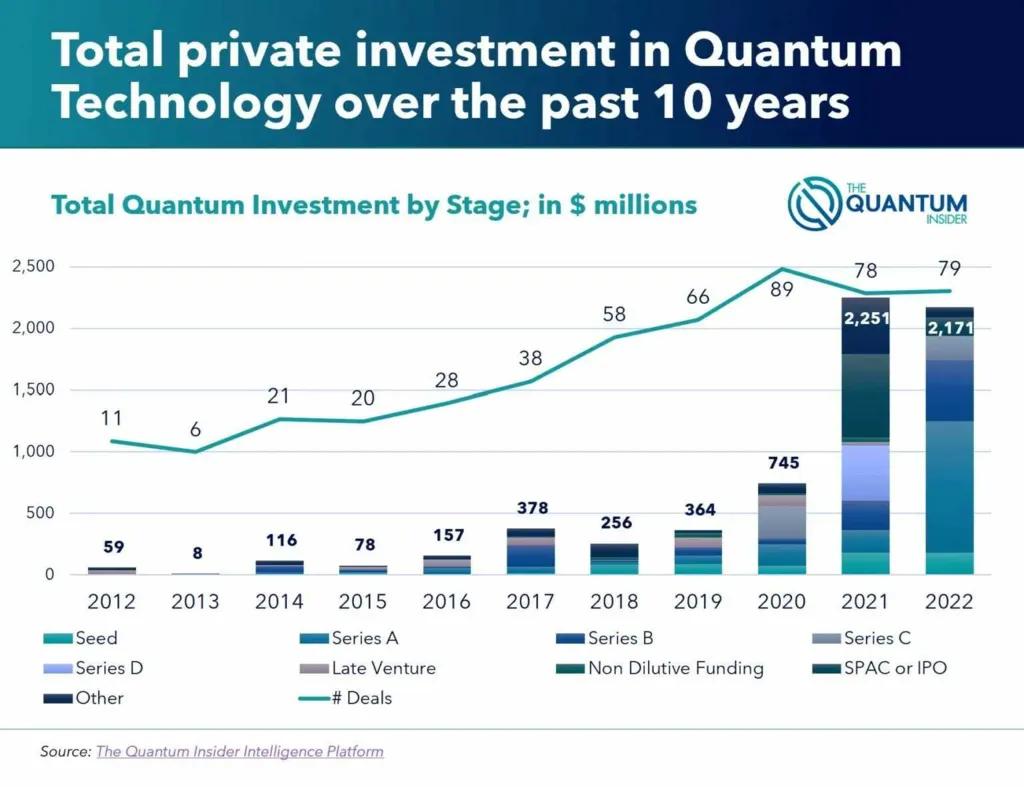

In just one year, global investment in quantum computing firms jumped from $550 million in Q1 2024 to $1.25 billion in Q1 2025 — a massive 128% increase. This rapid growth signals not just rising interest but growing confidence in the future of quantum technologies worldwide.

Public investment in quantum technology startups reached $1.8 billion globally in 2024, with Asia playing a big role in driving this momentum.

Read Also: Southeast Asia Quantum Investments Are Getting Serious

Singapore Leads Southeast Asia's Quantum Charge

Singapore is at the heart of the Southeast Asia Quantum Funding Surge. The country has already committed S$800 million (US$600 million) to quantum research since 2002. On top of that, it announced an additional S$300 million (US$222 million) over the next five years through its National Quantum Strategy.

This strategy focuses on four main pillars: scientific excellence, engineering capabilities, talent development, and industry partnerships. The goal is to train up to 100 PhD and Master’s students in quantum-related fields to build a skilled workforce that can lead future innovation.

This funding boost is part of Singapore’s broader S$25 billion Research, Innovation, and Enterprise 2025 plan, reinforcing its ambition to be a global tech leader.

Rising Private Sector Participation

While governments play a key role, private companies are also fueling the Southeast Asia Quantum Funding Surge. Companies like Singtel have launched Southeast Asia’s first quantum-safe network and are partnering with major global tech players like Cisco, Fortinet, and Nokia to develop quantum security solutions.

Meanwhile, new quantum startups are emerging across Asia. In 2024 alone, 5 out of 19 new quantum startups were founded in Asia, reflecting the private sector’s growing confidence and investment in this space.

Asia Pacific's Rapid Market Growth

The Asia Pacific quantum computing market, which includes Southeast Asia, is projected to grow at an impressive 38.2% compound annual growth rate (CAGR). This is driven by strategic public investments, private partnerships, and strong regional demand for advanced digital solutions.

Countries across the region are now actively building quantum hubs and developing talent pipelines to prepare for this market boom.

Southeast Asia Quantum Funding Surge: A Blueprint for the Future

The Southeast Asia Quantum Funding Surge is not just about technology. It represents a blueprint for regional growth and economic transformation. By investing heavily in quantum research and supporting startups, Southeast Asia is positioning itself as a serious player in the global tech landscape.

These combined efforts promise not only to drive technological breakthroughs but also to create high-value jobs and strengthen digital security across industries.

Southeast Asia Quantum Funding Surge: What's Next?

With strong government support, rapid private sector growth, and ambitious talent development, Southeast Asia’s quantum ecosystem is poised for unprecedented expansion. The Southeast Asia Quantum Funding Surge signals a future where the region doesn’t just adopt advanced technology, but shapes it.