Consumer Trends Shaping the Southeast Asia FMCG Market

A recent study highlights that post-pandemic, COVID-19 transmission no longer drives trends in the Fast-Moving Consumer Goods (FMCG) market in Southeast Asia. Instead, emerging socio-economic and behavioral patterns are shaping the industry’s future. With worsening unemployment and uncertain financial prospects, new consumer behavior resets — such as the basket reset, homebody reset, rationale reset, and affordability reset — are driving consumption patterns in the region. In this article, our perspective as expert Asia FMCG Consulting provides an in-depth analysis of these trends.

Basket Reset: Shifting Priorities in Consumer Purchases

The study anticipates a fundamental reset in consumer basket priorities. Key FMCG categories, including alcohol (-9%), healthcare (-3%), personal care (-5%), and beverages (-8%), have seen sales declines in the year-to-date period ending in June. These trends indicate that consumers are minimizing added basket expenses and reassessing what goes into their shopping carts.

Consumers’ responses are now less influenced by the news cycle and more by economic downturns and workforce transformations. This shift will affect where and how households stock their pantries in the post-pandemic world. Decisions will need to reconcile long-standing purchase habits with today’s reality, where health and value priorities compete side by side.

Homebody Reset: In-Home Consumption Takes Center Stage

The evolving routines of consumers at home are reshaping FMCG markets. DIY behaviors and the demand for in-home branded experiences have persisted beyond lockdowns and store reopenings. In the Philippines, 24% of consumers switched to smaller pack sizes, indicating a preference for products that suit a homebound lifestyle. Food and dairy saw a significant uptake, with sales in Singapore up by 42.6%, the Philippines by 11.4%, and Malaysia by 6.8%.

In Malaysia, sales of hair colorants increased by 22.8% as consumers opted for home grooming. Similarly, processed frozen food sales in Singapore rose by 113.7% due to home cooking. In Vietnam, 82% of consumers reduced out-of-home consumption, leading to increased sales of instant noodles (14.1%), sterilized sausages (17.9%), meal makers (7.4%), and mayonnaise (31%).

Companies aligning with DIY behaviors can succeed by offering affordable, accessible, and branded take-home experiences. Consumers are willing to bring product experiences into their homes, creating opportunities for companies to respond with innovative solutions.

Rationale Reset: Redefining FMCG Significance

The significance of FMCG goods is being redefined as consumers cut down on expenses. According to a collaboration between The Conference Board and Nielsen, 83% of Asia Pacific consumers reduced spending in Q2 2020, up from 73% in Q4 2019. Consumers are spending less on takeaway meals, holidays, out-of-home entertainment, and new clothing.

Consumers are turning to FMCG products to fill entertainment and experience gaps. In Singapore, sales of snacks and alcohol have increased by 25% and 15%, respectively. Consumers justify premium spending based on benefits and convenience, even amid financial constraints.

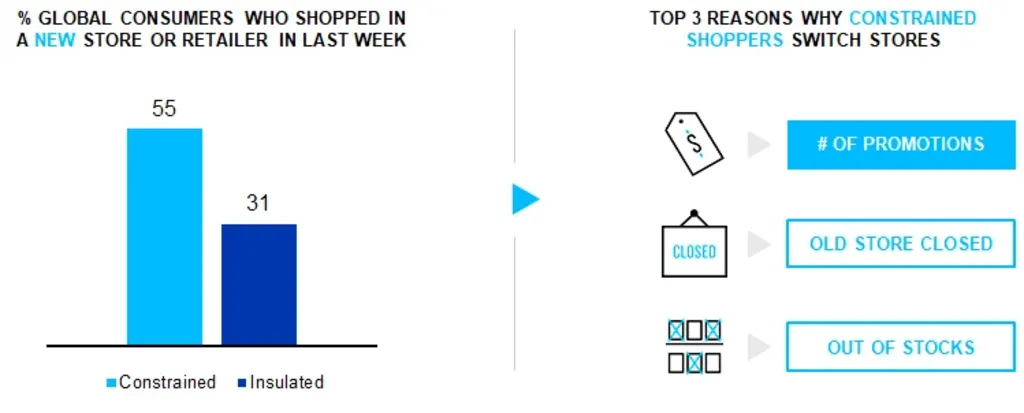

Affordability Reset: Optimizing Basket Spend

With declining disposable incomes, consumers are optimizing their basket spend to balance health and value needs. Over one-third of surveyed consumers noticed fewer promotions in stores. The study reports historically low trade promotion activity across various countries. Channel preferences are also shifting towards affordability. In Malaysia, mini-marts gained importance, with an 18% sales rise in June 2020 compared to 9% last year, offering close-to-home access to groceries at desired prices.

In Vietnam, the Modern Trade channel posted positive growth, with a 13% increase in value sales in YTD June 2020. The mini-mart format saw a 51% rise in the number of stores. FMCG companies need to tailor their offerings to consumers’ priorities, simplify omnichannel fulfillment, and enhance shopping experiences in the new reality.

Conclusion

The Southeast Asia FMCG market is undergoing significant changes driven by new consumer behavior patterns. Companies must adapt to these trends to meet evolving consumer needs and preferences. As Asia FMCG Consulting experts, staying ahead of these shifts will be crucial in navigating the future of the industry.