The use of crypto-based payments is accelerating across Southeast Asia. From retail consumers to institutional investors, the region is experiencing rapid adoption of digital assets for transactions and investment. This Southeast Asia Crypto Payments Boom reflects both grassroots demand and strong investor backing.

Vietnam Leads Regional Adoption

Vietnam stands out as the global leader in the adoption of Southeast Asia Crypto Payments Boom. About 21% of its population holds crypto assets, more than three times the global average of 6.8%. This makes Vietnam one of the most important markets for digital finance innovation. Its population is young, digitally savvy, and open to alternative payment systems, helping drive the country’s position at the front of this movement.

Other countries are also showing strong momentum. The Philippines and Thailand consistently rank among the top globally for crypto adoption. Together, these markets highlight Southeast Asia’s reputation as one of the fastest-growing digital asset regions in the world.

Southeast Asia Crypto Payments Boom: Explosive Growth in Indonesia

Indonesia has become one of the most dynamic centers for crypto transactions. Between 2021 and 2023, transaction volumes surged 350%, hitting $30 billion by late 2023. By the first quarter of 2025 alone, about $6.9 billion worth of transactions were processed.

The number of crypto investors in Indonesia is also rising sharply. By the end of 2024, there were 22.9 million investors, with forecasts placing this number between 25 million and 28 million in 2025. Such rapid wallet adoption shows how digital assets are becoming mainstream in one of Asia’s largest economies.

Smartphone Access Accelerates Southeast Asia Crypto Payments Boom

A key driver of adoption across the region is the high level of smartphone penetration. Over 90% of internet users in Southeast Asia go online using their smartphones. This makes mobile-first wallets the most effective gateway for digital assets.

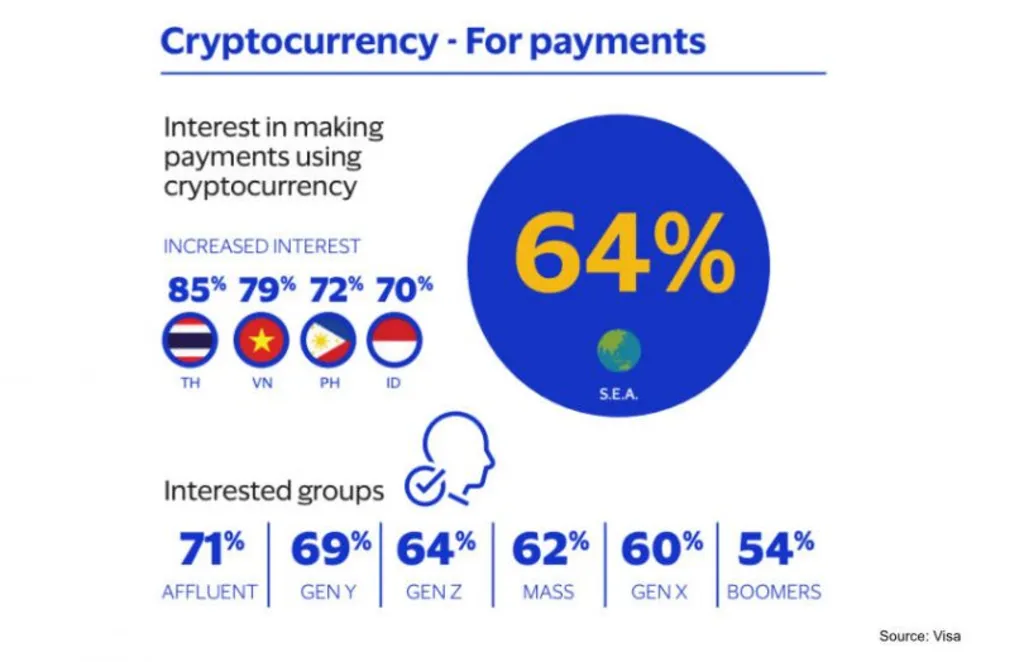

Consumers are also showing growing interest in actually using crypto for payments, not just investment. Surveys suggest that 64% of Southeast Asians are interested in making transactions with crypto. This signals a shift from speculative trading toward practical usage in daily life.

Institutional Investors Enter the Space

The boom is no longer limited to retail users. Nearly 69% of crypto transaction volume in Southeast Asia comes from institutional investors. This includes trading firms, funds, and large enterprises experimenting with blockchain-based payments.

This shift marks a crucial step toward market maturity. Institutional involvement not only adds liquidity but also creates more trust among regulators and businesses. It also helps stabilize markets that have traditionally been seen as volatile.

Funding and Market Outlook

Investor confidence remains strong. Venture capital funding dedicated to crypto in Southeast Asia rose by 20% in 2024, reaching $325 million. This growth came despite a 24% overall decline in fintech funding. Such resilience highlights the unique confidence investors have in crypto innovation.

The market outlook reflects this optimism. The Southeast Asia crypto market is projected to generate $9.2 billion in revenue by 2025, growing at a compound annual growth rate of 8.2%. By 2026, it is expected to exceed $10 billion. A regional increase of 25% in crypto transactions shows that adoption momentum is unlikely to slow.

Read Also: Financial Inclusion ASEAN Deepens Through Fintech Innovations

Digital Payments: Southeast Asia Crypto Payments Boom

Southeast Asia is shaping the future of digital payments. With Vietnam leading in ownership, Indonesia driving transaction volumes, and regional consumers showing strong interest, the Southeast Asia Crypto Payments Boom is well underway. Institutional players and venture investors are fueling this growth, ensuring the ecosystem matures in a sustainable way. The combination of mobile-first access, consumer demand, and investment capital positions Southeast Asia as a global leader in crypto-based payment innovation.