Southeast Asia’s sneaker market is stepping into a period of explosive growth. Valued at $1.613 billion in 2021, it’s projected to nearly double by 2033, reaching $2.899 billion. This steady rise, driven by a 5.01% CAGR, signals more than just fashion trends. It marks the Southeast Asia Sneaker Resale Boom as a serious economic movement.

Annual sneaker sales are expected to hit $1.97 billion by 2025. From there, a continued growth rate of 5.7% through 2030 shows this isn’t a short-lived hype, but a solid, long-term industry. Let's take a look!

Gen Z Drives Southeast Asia Sneaker Resale Boom and Demand

A major force behind the Southeast Asia Sneaker Resale Boom is Gen Z. With their deep connection to digital platforms, young consumers across Indonesia, Thailand, Vietnam, and the Philippines are reshaping sneaker culture. They’re not just buyers—they’re sellers, collectors, and trendsetters.

Asia Pacific holds 35% of the global sneaker market share. That dominance is in part thanks to Southeast Asia’s youthful, digital-first population. Analysts point to 2025 as a turning point, calling the region a “hotspot for foreign investment” in the sneaker resale space.

Southeast Asia Sneaker Resale Boom: Digital Platforms Fuel Resale Growth

With 2.71 billion people shopping online globally and over 20% of all retail sales happening via e-commerce, it’s clear digital platforms are key to retail. In Southeast Asia, sneaker reselling thrives on peer-to-peer apps, social media marketplaces, and specialized platforms like StockX and Carousell.

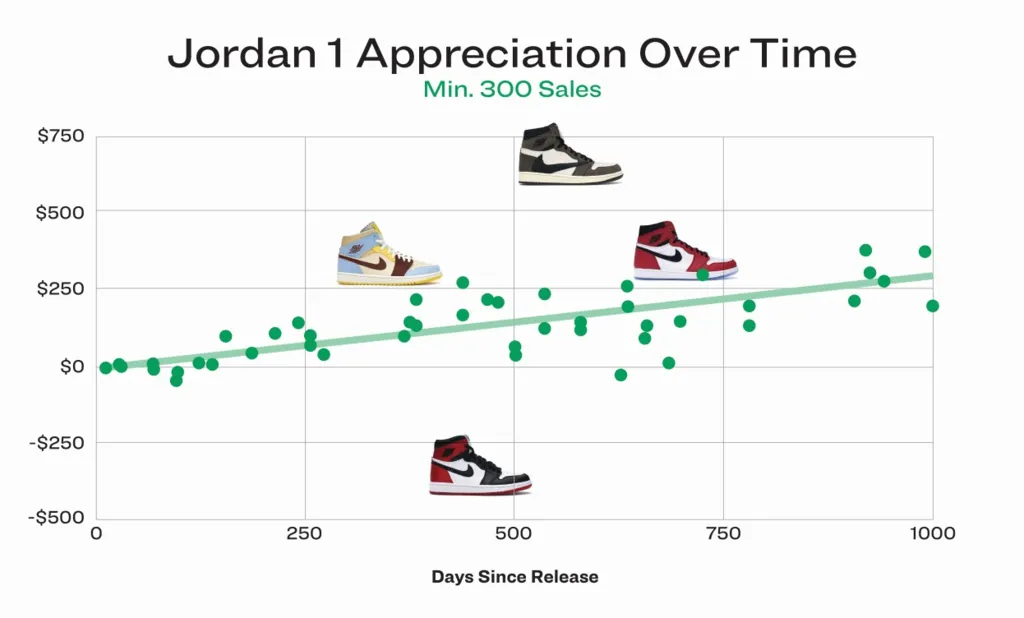

This shift has blurred the line between fashion and investment. Sneakers are now seen as tradeable assets, especially limited editions, boosting their resale value and pushing the sector further into the mainstream.

Read Also: Southeast Asia Digital Trade Sparks Tech Revolution

Tapping Into the Secondhand Economy

The sneaker resale trend fits into a much larger shift toward secondhand shopping. The Asia Pacific secondhand goods market hit $47.8 billion in 2025 and is forecast to grow at a fast 9.1% CAGR until 2035. Sneaker reselling is one of the most visible parts of that economy.

This growth reflects changing consumer priorities. Younger buyers care about sustainability, exclusivity, and digital convenience. Recommerce—including sneakers—ticks all three boxes.

A Culture Becomes a Market

The Southeast Asia Sneaker Resale Boom isn’t just about profit—it’s cultural. Streetwear, hip-hop, and sports influences shape the region’s sneaker demand. Events, influencers, and brand drops go viral within minutes, pushing resale prices up and driving intense online engagement.

As global sneaker revenue is projected to jump from $94.1 billion in 2024 to $157.9 billion by 2033, Asia Pacific’s influence—led in part by Southeast Asia—will only grow stronger.

Walking into the Future with Southeast Asia Sneaker Resale Boom

With strong digital infrastructure, a youthful population, and a booming secondhand economy, Southeast Asia is at the forefront of global sneaker resale. From Manila to Jakarta, resellers are building careers, investors are watching the trend closely, and brands are adjusting their strategies.

The Southeast Asia Sneaker Resale Boom is not a passing trend. It’s a multi-billion dollar movement that reflects broader shifts in how young people shop, spend, and connect with culture.

Read Also: Market Research Southeast Asia for Bold Growth & Expansion