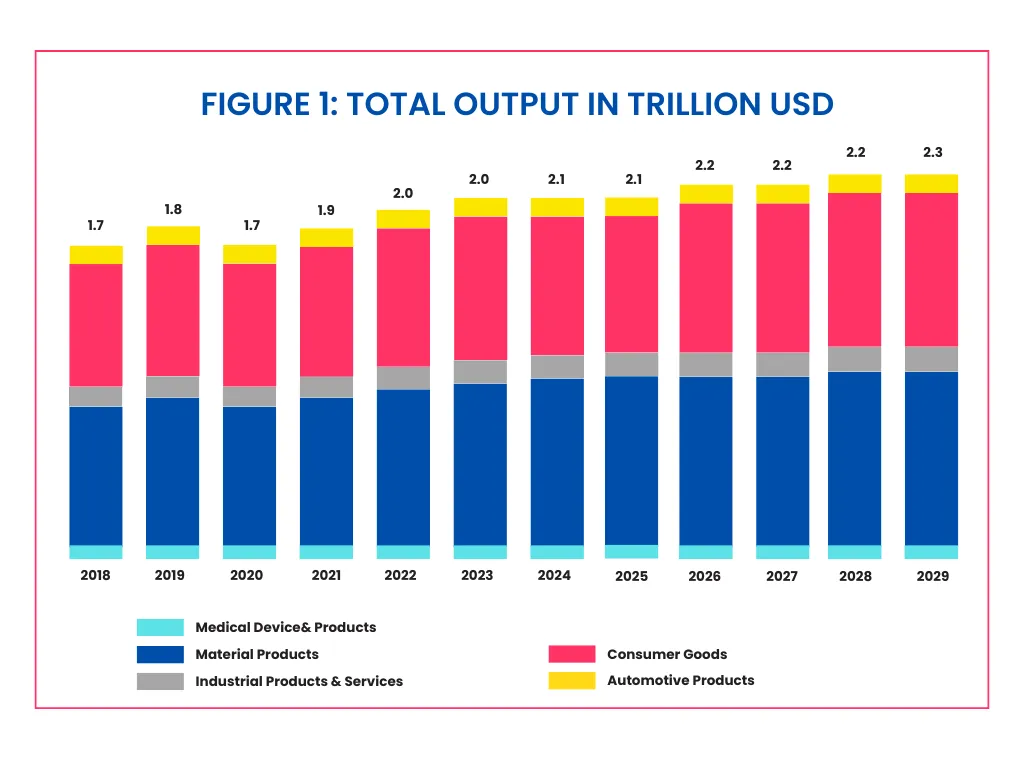

The Southeast Asia manufacturing hub is no longer an emerging concept but a strategic reality. The region’s manufacturing sector is projected to be worth over $700 billion by 2025, growing steadily at a 2.3% to 2.4% CAGR through 2029. With a 650 million-strong consumer base and the world’s third-largest labor force, Southeast Asia offers both production power and market depth.

Global supply chain shifts accelerated by COVID-19 disruptions and rising geopolitical tension with China have fueled this transformation. The ASEAN region’s share of global exports climbed from 5.7% in 2018 to 6.6% in 2022, a clear signal that manufacturers are diversifying fast.

Strategic Diversification Fuels Regional Growth

Key drivers include low labor costs, proximity to major trade routes, and business-friendly policies. Vietnam, Thailand, and Indonesia have seen a surge in foreign direct investment (FDI), particularly in electronics, automotive, and chemicals.

Vietnam’s manufacturing wages are roughly half those in China, making it a top relocation choice. Meanwhile, the manufacturing sector expanded by 4.0% in Q1 2025, reflecting ongoing momentum even in a slower macro environment.

Vietnam, Malaysia, and Thailand: Leading the Shift in Southeast Asia Manufacturing Hub

Vietnam has become a global electronics and textile powerhouse. Its exports jumped from $320 billion in 2019 to $440 billion in 2023, showing how fast the country has climbed global value chains.

Thailand contributes 27% of GDP from manufacturing, with strength in automotive and electronics. Its Manufacturing PMI remains above 50, indicating sustained expansion.

Malaysia specializes in semiconductors and machinery, with manufacturing making up 22.3% of GDP. Well-developed industrial zones make it a prime player in the regional ecosystem.

Focus Sectors in Southeast Asia Manufacturing Hub

Southeast Asia’s strength lies in key sectors:

-

Electronics: Vietnam and Malaysia are central to global semiconductor and device supply chains.

-

Automotive: Thailand leads, especially in electric vehicle (EV) components, thanks to tax incentives and skilled labor.

-

Apparel: Vietnam stands among the world’s largest exporters, boosted by diversified US and EU trade relationships.

FDI and Trade Agreements Expand Market Access

FDI flows into ASEAN manufacturing continue to rise as firms diversify from China. Regional deals like the RCEP (Regional Comprehensive Economic Partnership) give Southeast Asia unmatched trade connectivity.

These agreements reduce tariffs and improve investor confidence, helping foreign manufacturers tap into both global and intra-ASEAN markets.

Infrastructure and Labor: Opportunities and Challenges

Countries like Singapore, Thailand, and Malaysia offer advanced logistics, but others like Vietnam and Indonesia are rapidly upgrading infrastructure to meet demand.

Labor supply, once an advantage, now faces strain. Rising wages and skills mismatches are pressing concerns. Governments are responding by investing in technical education and vocational training to maintain competitiveness.

Read Also: Next-Gen Mobility: Singapore’s Smart Logistics Hub and Autonomous Trials

Why Southeast Asia Is the New Global Production Frontier

With over $700 billion in manufacturing output by 2025, Southeast Asia is not just keeping pace. As companies look to de-risk their supply chains, the Southeast Asia manufacturing hub offers the right mix of scale, cost efficiency, and connectivity. Smart manufacturers that embrace this transition now, by leveraging trade agreements, incentives, and regional networks, can position themselves at the new center of global production.

Read Also: New Frontiers in Southeast Asia Digital Infrastructure