The Future Just Got a Fast Charge in Singapore

Tesla’s launch of its V4 Supercharger in Singapore isn’t just another step in EV adoption—it’s a leap. It marks Southeast Asia’s entry into the latest generation of global charging infrastructure, placing Singapore alongside markets like the U.S., Netherlands, and France.

Installed at Millenia Walk, the new site introduces:

- V4 architecture with peak output up to 250 kW,

- CCS2 compatibility, allowing non-Tesla EVs to charge,

- Contactless payment, extending accessibility for all users.

This is the first V4 charger in Southeast Asia, and only the ninth globally, signaling Tesla’s strategic prioritization of Singapore as a launchpad for its regional ambitions.

Singapore’s EV Readiness: Policy + Urban Design = Acceleration

source image: Eurogroup Consulting Analysis

Singapore’s embrace of Tesla’s new tech is a clear validation of its electric vehicle ambitions. Already home to over 4,000 public EV chargers, the city-state is targeting 60,000 chargers by 2030—a 15x increase in just six years.

What makes this possible?

- Smart urban design: Singapore’s dense, planned urban environment allows efficient siting of charging hubs

- Forward-thinking regulation: Since 2021, the government has phased in incentives, including the EV Early Adoption Incentive (EEAI)—up to S$20,000 off new EV purchases.

- Holistic mobility policy: EV adoption is tied to carbon pricing, parking design, and public fleet electrification.

As a result, Singapore’s EV share of new car sales surged from 0.2% in 2020 to over 12% in 2023, with forecasts pointing to a 30% share by 2026.

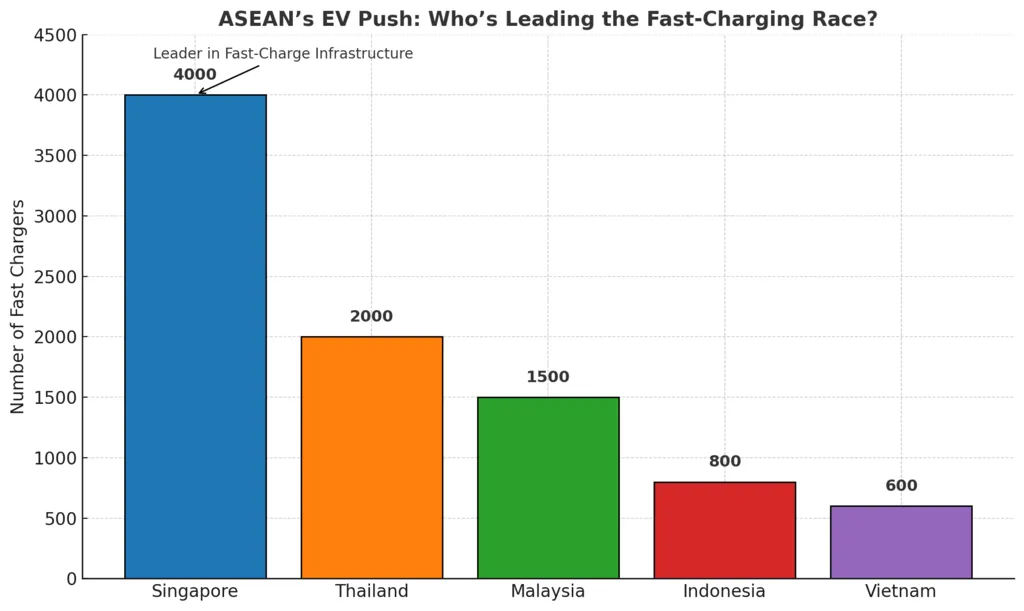

ASEAN Charging Infrastructure Snapshot

Singapore is clearly in the lead. But the potential across the region is massive:

While Singapore is charging ahead, large markets like Indonesia and Vietnam are still underdeveloped—making them ripe for infrastructure investment and smart city solutions.

Policy Domino Effect: One Supercharger, Many Reactions

Tesla’s V4 Supercharger has already started to ripple across ASEAN capitals. Why? Because infrastructure signals confidence—and confidence drives policy.

Thailand—the second-most advanced EV market in the region—recently announced subsidies for home and commercial chargers, and aims for 1.5 million EVs on the road by 2030.

Indonesia is wooing battery manufacturers with nickel and cobalt resources, while accelerating its EV roadmap with new tax cuts and fleet electrification targets.

Malaysia has opened the fast lane for public-private EV station partnerships and fast-tracked building code revisions to allow mandatory charger installations in new developments.

Singapore’s role? A sandbox and lighthouse, showing others what good looks like.

Business Opportunities: A Fast-Charging Value Chain From cables to cloud software, Tesla’s arrival creates ripple effects for dozens of industries. The EV charging value chain includes:

- Civil works & engineering firms for site deployment and electrical setup.

- Smart grid integrators to manage energy loads and integrate solar + storage.

- Digital solution providers for mobile apps, billing systems, route optimization.

- Component manufacturers for power units, cooling, metering, and enclosures.

- Real estate developers converting parking assets into revenue-generating charge points.

Singapore-based startup ChargeX has already raised Series A funding to scale intelligent load-balancing EV charger networks for malls and offices—with Indonesia and the Philippines in its next phase.

Urban Infrastructure: Reinventing the Grid

EVs are reshaping city planning in real time. Tesla’s V4 Supercharger is a symbol of the transformation underway.

Key infrastructure challenges cities must address include:

- Energy resilience: High-speed chargers increase electricity demand peaks, requiring grid reinforcement and decentralization.

- Mobility integration: Chargers need to be embedded within broader transit ecosystems—alongside buses, last-mile delivery hubs, and bike-share stations.

- Data orchestration: Usage data from EV chargers can inform future urban zoning, pricing, and even power storage investments.

Already, Singapore’s Jurong Innovation District is piloting “energy-agnostic mobility zones”—with shared charging, autonomous vehicle lanes, and AI-optimized parking.

Singapore: ASEAN’s EV Laboratory

Singapore is uniquely positioned to serve as a testbed for regional EV solutions. Why?

- It’s regulator-friendly: with clear environmental targets and streamlined approvals.

- It’s tech-integrated: data-driven planning meets citizen-centric design.

- It’s scalable: what works in Singapore often becomes a model for Bangkok, Kuala Lumpur, or Manila—with local tweaks.

Several ASEAN countries are watching closely:

- Vietnam’s Vingroup is studying high-power charger placement.

- The Philippines’ Department of Energy is exploring Tesla-style payment models.

- Thailand’s EGAT is benchmarking V4 design for highway corridors.

Beyond Hardware: Knowledge and Influence Matter

This isn’t just about a plug—it’s about creating a blueprint. France, Germany, China, and the U.S. are all exporting EV products. But Singapore can export:

- Urban policy models for EV integration.

- Smart grid tech for tropical cities.

- Public-private innovation frameworks applicable across Southeast Asia.

Final Charge

Tesla’s V4 Supercharger in Singapore is a high-voltage moment for Southeast Asia. It offers more than electrons—it offers a vision: cities as clean, connected ecosystems, powered by bold infrastructure, policy innovation, and business partnerships.

For public authorities, urban planners, investors, and entrepreneurs: the question isn’t if the EV wave is coming. It’s whether you’re positioned to ride it.

Let’s Power Up Together

At Eurogroup Consulting Southeast Asia, we guide public and private sector players across the EV transition—from strategy and policy to operations and go-to-market. Let’s build Southeast Asia’s future of mobility, together. Contact us today

FAQs

1. Why is Tesla’s V4 launch important for Southeast Asia?

It sets a new standard for EV charging—ultra-fast, inclusive (non-Tesla support), and experience-driven. This raises expectations for future infrastructure across the region.

2. Who benefits from this launch?

Beyond EV drivers, it creates momentum for government planners, utility companies, real estate players, and digital innovators.

3. Could this lead to more Tesla facilities in Southeast Asia?

Yes. Superchargers often precede vehicle sales surges and retail expansion. Singapore could anchor future Tesla showrooms, service centers, or even R&D hubs.