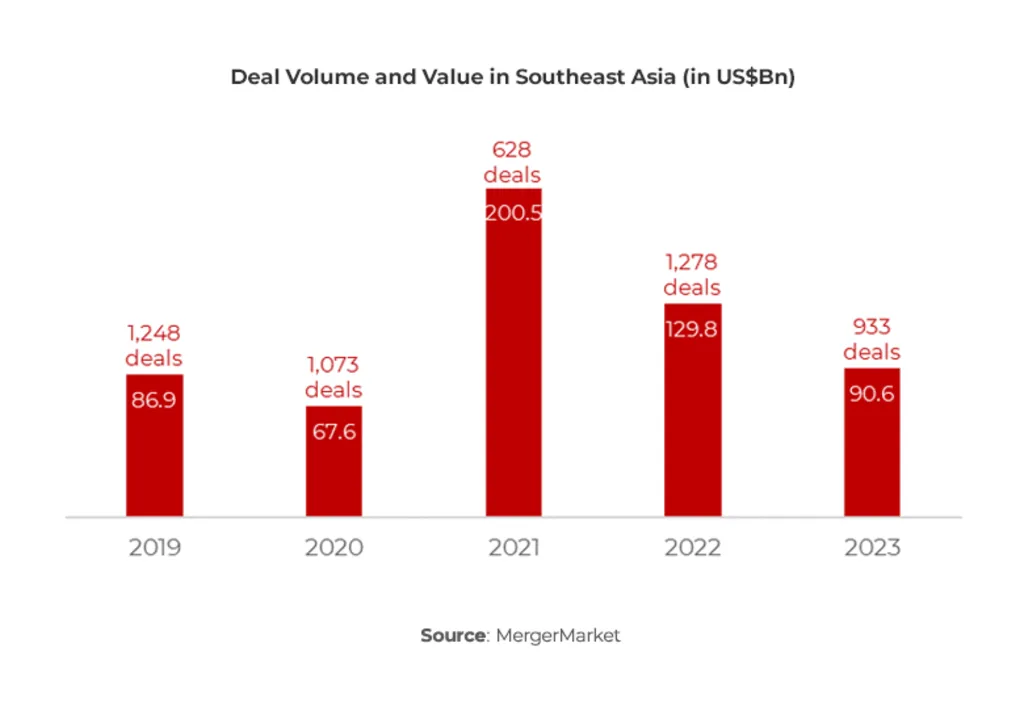

Deal activity in the Asia-Pacific region has started 2025 on a steadier note. While venture finance faces declines, mergers and acquisitions (M&A) are providing momentum. The result is a modest 1% year-on-year increase in overall deal activity, driven by large-scale transactions and improving regional confidence. For Southeast Asia Deal Volume Rebound, the story is one of resilience, with M&A offsetting venture weakness and sustaining investor interest.

Southeast Asia Deal Volume Rebound: M&A as the Driving Force

M&A deals remain the anchor of Asia-Pacific’s deal growth. In 2025, the region’s average deal size reached $133 million, a 22% jump compared to 2023, and 12% higher than the five-year average. The rise in large transactions and megadeals shows that investors are prioritizing strategic consolidations and acquisitions, even as smaller venture deals struggle.

This signals growing maturity in the APAC deal landscape, with a tilt toward stable, larger deals that provide stronger long-term returns.

Southeast Asia’s 1 Surge

In Southeast Asia, M&A activity surged in Q1 2025, with deal value expanding by 296.1% quarter on quarter. This extraordinary growth was largely fueled by Indonesian state-owned enterprise (SOE) restructurings, which represented 71.6% of total deal value.

Even when removing these outsized SOE deals, the region’s deal value still rose 12.3% and deal volume grew 29% compared to the previous quarter. This demonstrates that the Southeast Asia Deal Volume Rebound is not solely reliant on government restructuring but also supported by a recovery in private-sector transactions.

Read Also: Southeast Asia SPAC Investment Sectors Target Tech & Clean Energy

Read Also: Renewable Energy Deals in SEA Surpass USD 20B in 2025

Q2 Stability Despite Declines

By Q2 2025, deal value in Southeast Asia fell 60.9% quarter on quarter, reflecting the absence of large SOE transactions. However, the underlying picture was far more encouraging. Excluding those outsized deals, deal value actually grew 21.9%, and deal volume stayed broadly flat.

This resilience highlights the region’s ability to sustain core deal activity despite volatility in headline figures.

IPO Market Regains Energy

Southeast Asia’s IPO market also contributed to confidence. In H1 2025, the region raised US$1.4 billion across 53 listings. This resurgence signals that companies and investors are regaining trust in public markets, and it adds depth to the broader deal activity.

IPOs, alongside M&A, reflect a gradual strengthening of deal pipelines across multiple channels, even as venture activity slows.

Venture Finance Struggles

In sharp contrast, venture finance is under pressure. Southeast Asia’s startup funding in H1 2025 hit a six-year low of USD 1.85 billion, a 20.7% decline year on year.

This contraction suggests that early-stage financing faces hurdles from investor caution, tighter global liquidity, and concerns about valuations. Yet, the stability of M&A and IPO activity shows that capital is still flowing into the region—just more selectively and at later stages.

Southeast Asia Deal Volume Rebound and The Implications for the Region

The combination of modest overall APAC growth and a clear Southeast Asia Deal Volume Rebound suggests that the region is becoming more resilient. The focus on large transactions, state-backed restructurings, and IPOs provides stability, while venture finance recalibrates to new market conditions. For investors, this means opportunities remain strong in established sectors, while startups may face more scrutiny in raising capital. For Southeast Asia, the continued momentum points to improving fundamentals despite external uncertainties.

FAQs

1. What drove Southeast Asia’s deal rebound in Q1 2025?

Indonesian SOE restructurings fueled growth, but private-sector deals also grew by 29% in volume.

2. How did deal activity in Asia-Pacific perform overall?

It rose by about 1% year on year, with average deal sizes reaching $133 million, a 22% increase over 2023.

3. Why is venture finance declining in Southeast Asia?

Startup funding dropped 20.7% YoY due to investor caution, liquidity tightening, and valuation concerns.

4. Are IPOs recovering in Southeast Asia?

Yes, IPOs raised US$1.4 billion across 53 listings in H1 2025, showing improved confidence in public markets.

5. What does the rebound mean for investors?

It suggests more stability in M&A and IPOs, while startups may face tougher funding conditions.