Southeast Asia is rapidly becoming a global hotspot for climate innovation. With growing public and private backing, the region’s green tech landscape is scaling rapidly and reshaping everything from agriculture to energy. At the center of this transformation is strong, targeted Southeast Asia climate tech support, including record investment, major international funding, and thriving local startups.

$221 Million Boost for Climate Innovation

In July 2024, the Green Climate Fund (GCF) approved $221 million to strengthen climate tech in five countries: Cambodia, Lao PDR, Indonesia, the Philippines, and Vietnam. A core piece of this is a $200 million Climate Technopreneurship Fund, aimed at nurturing local climate startups, enabling tech transfers, and building joint ventures with global leaders.

This wave of investment isn’t just strategic—it’s necessary. Unlocking climate solutions in Southeast Asia could add $120 billion in new economic value and create 900,000 jobs by 2030, while addressing the region’s emissions gap.

Read Also: Backing Southeast Asia Climate Resilience Efforts to Save The Future

Southeast Asia Climate Tech Support: VC Appetite at Record Highs

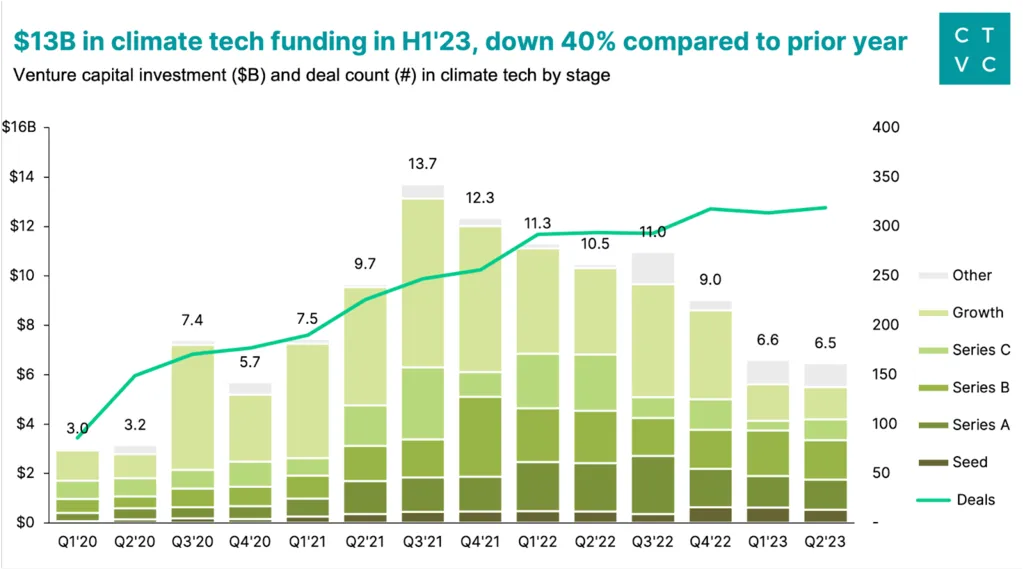

Venture capital has taken notice. Climate tech startup funding hit $1.11 billion in 2022, nearly doubling from the year before. Private green investments in the six largest Southeast Asian economies (SEA-6) jumped 43% in 2024 to $8 billion, with solar and waste management drawing strong interest.

One of the most promising segments? Agri- and decarbonization tech. Startups like FreshKet, which streamlines Thailand’s food supply chains, are attracting funding for their role in both food security and emissions reduction. Another standout is Rize, an Indonesian platform helping farmers increase yield with climate-smart data tools.

This signals a clear trend: investors are backing solutions that cut emissions and support livelihoods.

Read Also: Southeast Asia Climate Tech Investments Trends Reimagined

A Market on Fire: From $102B to $350B

The total value of Southeast Asia and India’s climate tech market was $102 billion in 2023. By 2030, that figure is expected to reach $350 billion, growing at over 20% CAGR. It’s one of the fastest-expanding markets globally.

Renewable energy remains the top magnet for capital. Since 2012, it has absorbed 41.5% of all climate tech funding in Southeast Asia. And it’s showing no signs of slowing—over $200 million flows into renewables every year, backed by both climate funds and infrastructure investors whose interest has grown 14x in just one year.

Southeast Asia Climate Tech Support: Big Tech, Big Impact

But support isn’t just financial. With more governments introducing policy incentives and new regulation—like Indonesia’s OJK stepping up oversight in 2025—the climate tech environment is becoming more stable, transparent, and trusted.

The GCF program aims to connect local entrepreneurs with global climate tech firms, driving collaboration and innovation across borders. That means faster scaling, better technology transfer, and real-world applications.

From Southeast Asia Climate Tech Support Funding to Futures

The rising tide of Southeast Asia climate tech support is more than a money story. It’s about enabling a generation of startups to solve the region’s most pressing challenges—climate risk, food insecurity, energy transition, and green job creation. From Bangkok to Bandung, founders like those behind FreshKet and Rize are showing what’s possible. With capital, policy, and global interest finally aligned, Southeast Asia’s climate tech boom has only just begun.