Building the Framework for a Regional Green Economy

Southeast Asia is fast becoming a global leader in carbon credit development. By the end of 2024, the region contributed 2.978 billion carbon credits, representing 56.19% of the global total. This dominance underscores how rapidly the Southeast Asia Carbon Credit Market Emergence is taking shape, supported by strong government action and growing investor interest in decarbonization.

The regional carbon market was valued at USD 866.04 billion in 2024, a clear sign of both economic potential and environmental momentum. However, local demand alone has not been sufficient to sustain growth. Indonesia’s IDXCarbon exchange, for instance, opened to international buyers in 2025 but has seen months without foreign trades. This shows that international participation is essential to fuel liquidity and market expansion.

Southeast Asia Develops Carbon Credit Market Infrastructure

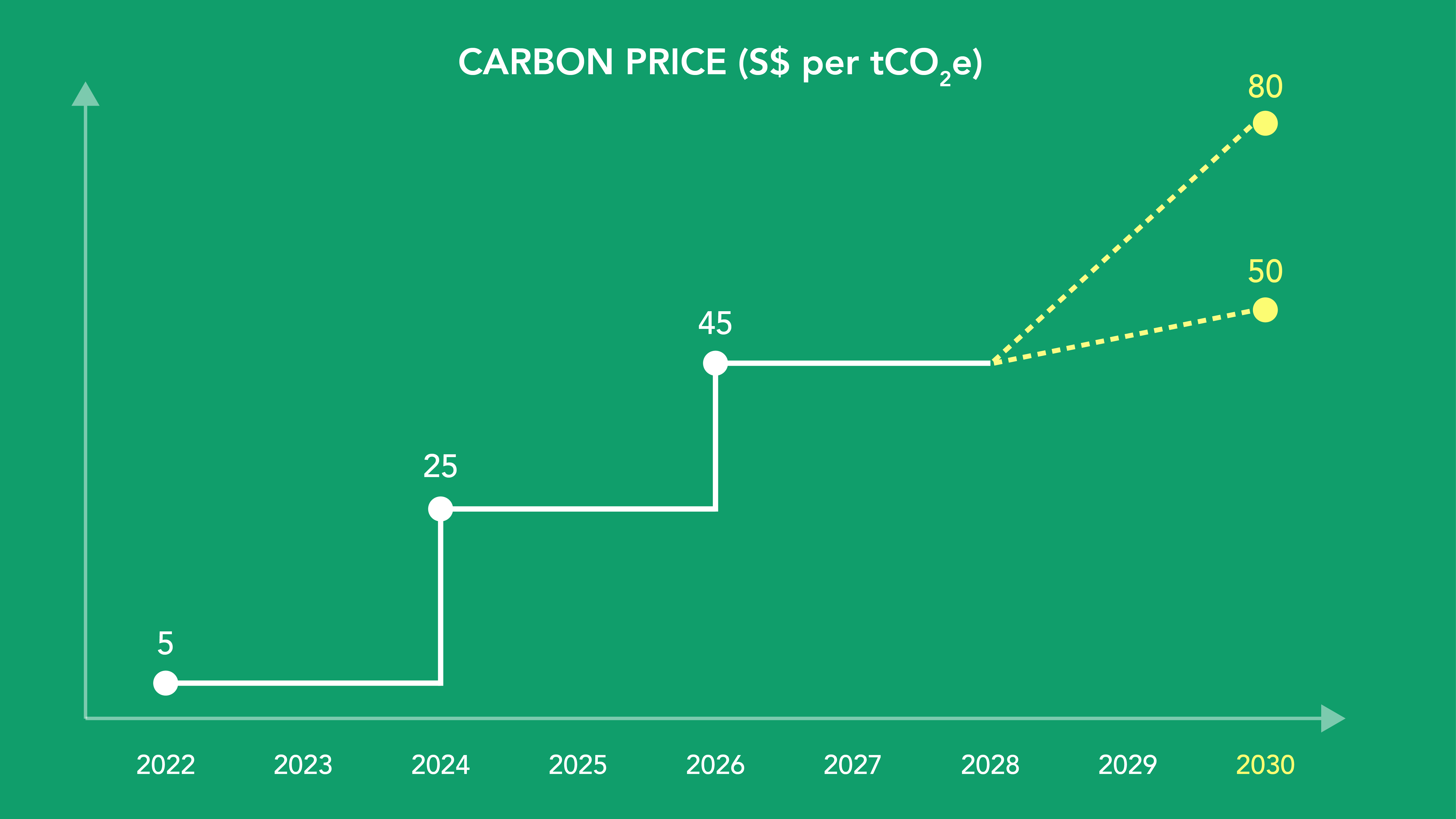

Across ASEAN, countries are creating solid foundations for their carbon trading ecosystems. Singapore stands out with one of the most ambitious policy frameworks. The country raised its carbon tax from SGD 5 per tonne to SGD 25 in 2024, with a plan to climb further to SGD 45 by 2026. This decisive move signals the government’s strong commitment to reducing emissions and strengthening its carbon market infrastructure.

Source: National Climate Change Secretariat

Source: National Climate Change Secretariat

Singapore also hosts two major carbon exchanges — AirCarbon Exchange and Climate Impact X. Both provide standardized contracts and transparent trading systems that help businesses and investors access credible carbon offsets. These platforms are vital in establishing trust and ensuring that trades align with international sustainability standards.

Meanwhile, Indonesia and Vietnam are refining national registries and methodologies to improve carbon credit verification integrity. Their aim is to create transparent systems that can issue high-quality credits recognized internationally. In Thailand and the Philippines, governments are exploring hybrid models that combine voluntary and compliance markets. This blended approach allows flexibility while aligning with Article 6 of the Paris Agreement, which governs international carbon trading mechanisms.

ASEAN Countries Build Regulatory Frameworks and Exchanges

A significant milestone in the Southeast Asia Carbon Credit Market Emergence came with the finalization of the ASEAN Common Carbon Framework (ACCF) in early 2025. The framework establishes governance structures, methodologies, and a roadmap to build a transparent and competitive regional carbon market.

The ACCF promotes mutual recognition of carbon credit methodologies among ASEAN member states. This coordination enhances credibility, reduces market fragmentation, and attracts more green finance investments to the region. It also prepares Southeast Asian exporters to adapt to global trade shifts, particularly the European Union’s Carbon Border Adjustment Mechanism (CBAM). Given that Southeast Asia is the EU’s third-largest trade partner, aligning regional carbon standards with international rules is both an environmental and economic priority.

As regional collaboration deepens, the carbon credit ecosystem is expected to mature rapidly. Strong policy backing, improved verification systems, and increased investor confidence are positioning Southeast Asia to become a key player in the global carbon economy.

The momentum behind the Southeast Asia Carbon Credit Market Emergence reflects a broader transformation — one where economic development and climate responsibility move hand in hand. Through unified action and transparent regulation, ASEAN nations are laying the groundwork for a sustainable, low-carbon future that extends well beyond their borders.

Read also: SEA Carbon Credit Markets: Building the Foundation for a Low-Carbon Future