The 2025 SEA Influence Index Trends highlight a turning point in Southeast Asia’s balance of power. The latest SAII v3 report shows that regional countries are now shaping their own path more strongly than ever, while global powers continue to compete for influence.

China and the U.S.: A Tight Race for Regional Reach

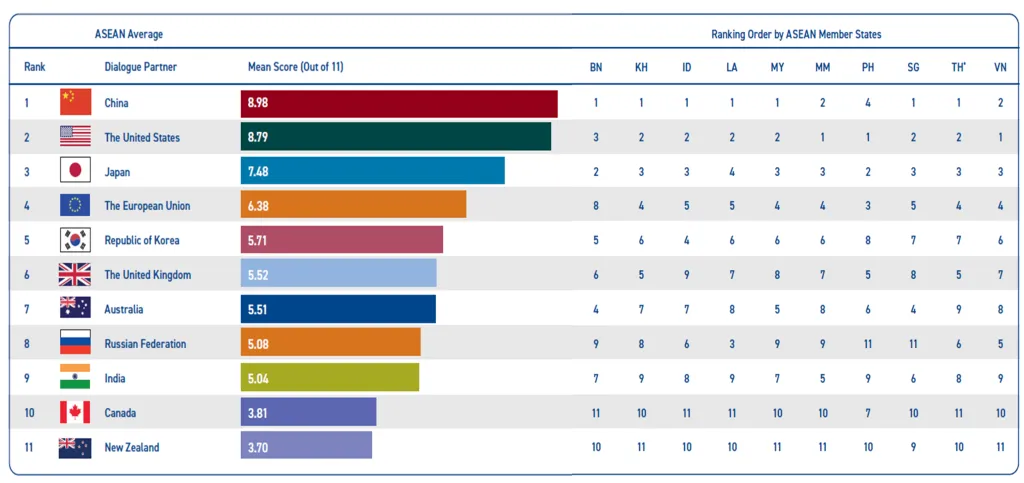

In 2025, China holds the highest influence score among external powers in Southeast Asia, registering 65.3, just ahead of the United States at 64.4. Japan trails further behind with 47.9. These numbers reveal a razor-thin contest between Beijing and Washington, reflecting the growing strategic importance of the region.

Yet, despite this competition, the report finds that Southeast Asian countries collectively exert more influence over each other than any single outside power. This underscores a key reality: ASEAN’s own internal trade, diplomacy, and security networks now weigh more heavily than any foreign player.

SEA Influence Index Trends: Indonesia Leads, Singapore and Malaysia Follow

The SAII v3 index ranks Indonesia, Singapore, and Malaysia as the top three regional powers in 2025. Indonesia stands out as the “one-strong” leader, maintaining its edge across economic and military dimensions. Singapore and Malaysia are close behind as “two-medium” powers, each combining economic efficiency with strong diplomatic and technological influence.

Read Also: Southeast Asia Influence Index Rise Is Led by Indonesia and Singapore

Together, these countries shape much of the region’s direction — from digital infrastructure to defense partnerships — and set the tone for how ASEAN countries manage their autonomy amid global rivalry.

Mid-Tier Nations on the Move

The 2025 results show a “one-strong, two-medium, three-stable” structure in Southeast Asia’s hierarchy. Thailand and the Philippines have both risen in the rankings, signaling their growing role in regional affairs. In contrast, Vietnam has slipped slightly, reflecting changing conditions in military and technological performance.

These SEA Influence Index Trends emphasize that power in the region is fluid, not fixed. Mid-tier countries are gaining ground, creating a more competitive and unpredictable regional order.

Military and Technology Drive Influence Gains

A deeper look at the SAII v3’s marginal effects analysis reveals that military and socio-technological dimensions have the strongest impact on national influence, showing sensitivity levels of about ±0.002. This means investments in defense modernization, innovation, and digital capacity bring the highest influence returns.

For policymakers, this finding highlights where strategic efforts should focus — not only strengthening economic performance but also securing technological and defense advancements.

Inside the SAII v3 Methodology

Unlike traditional rankings, SAII v3 combines advanced quantitative models — including Entropy Weighting, CRITIC, and Principal Component Analysis — to reduce bias and improve consistency.

Scores are weighted across four dimensions:

- Economy: 35-40%

- Military: 20-25%

- Diplomacy: ≈20%

- Socio-technology: ≈15%

This structure ensures a balanced view of national power that accounts for both hard and soft influence.

The index’s reproducibility and reliability have been tested through 10,000 bootstrap iterations, confirming its strength as a policymaking and forecasting tool.

Read Also: Southeast Asia AI-Driven Trade Expansion: Boosting Cross-Border Trade

SEA Influence Index Trends: A Region Defining Its Own Future

The 2025 SEA Influence Index Trends show that Southeast Asia is no longer a passive arena for global competition — it’s an active, self-reinforcing network of nations shaping their collective destiny. While China and the U.S. continue to vie for influence, ASEAN’s internal dynamics are proving just as powerful. As countries like Thailand and the Philippines climb the ranks, the region’s balance of power continues to evolve — and the next few years promise even greater shifts ahead.