Southeast Asia’s digital economy is evolving fast. With e-commerce penetration reaching 27% in 2025, the region is expanding but still behind China’s 55% peak and South Korea’s 42% in 2024. The gap shows both the promise and the challenges of the market. Southeast Asia E-commerce Models growth is happening, but it’s not uniform. Each country has its own languages, cultures, and consumer habits, which makes the region’s digital landscape complex.

Reshaping Southeast Asia E-commerce Models

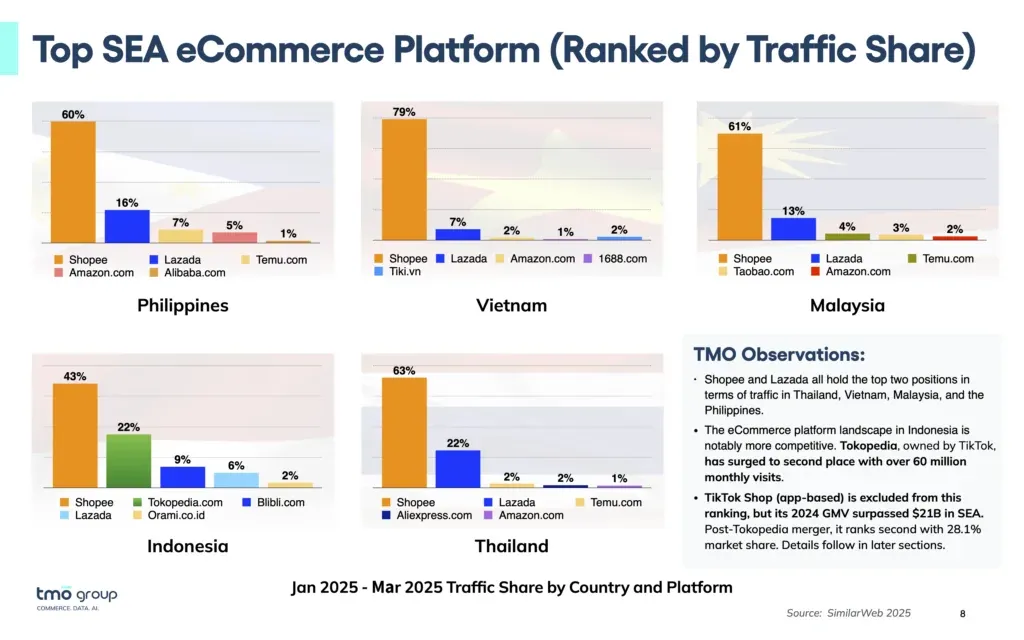

Even with that complexity, momentum is strong. Shopee, Lazada, and Tokopedia now dominate the market with a combined 84% share, yet new space is opening up. Smaller hybrid platforms and niche retailers are finding success by focusing on local behavior, such as what people buy, how they search, and how they communicate online. These players are tapping into the unique character of each market, from urban Singapore to rural Indonesia.

The growth potential is massive. By 2030, the region’s e-commerce gross merchandise value (GMV) is expected to more than double to USD 410 billion (SGD 535 billion). The race is now about who understands their customers better. That’s where domain-specific large language models (LLMs) come in.

Read Also: Fast-Tracking Change in Southeast Asia AI Adoption

Southeast Asia E-commerce Models: AI Meets Local Context

General-purpose AI models are powerful, but they struggle with regional nuance. Southeast Asia is home to hundreds of languages and dialects, from Tagalog to Bahasa to Burmese. The digital content people produce — product descriptions, customer reviews, social media posts — is often a mix of formal and informal language. There’s slang, spelling variation, and multilingual sentences all in one paragraph.

Domain-specific LLMs are built to handle this kind of data. Unlike generic AI, they’re trained on industry-relevant information and tuned to regional communication styles. They can understand when a shopper mixes Thai and English in a review or when a Vietnamese comment uses a local idiom to express frustration. This linguistic sensitivity allows platforms to engage users naturally and accurately.

Companies adopting these models are already seeing better results. Improved personalization and smoother customer interactions lead to higher conversion rates. In a market as dynamic as Southeast Asia, these advantages directly translate into revenue and loyalty.

Read Also: Southeast Asia E-commerce Trends Shift to Speed & Convenience

Compass-v3: Tackling the Noise

Among the new generation of AI models, Compass-v3 stands out for its multilingual design. It’s built to handle noisy, mixed-language data, and exactly the kind found in Southeast Asia’s e-commerce systems. When customers search using half-English, half-local terms, Compass-v3 helps search engines and recommendation systems understand the intent correctly.

That matters because the region’s online retail is rich but messy. Data comes from many sources: social platforms, chat apps, informal sellers, and marketplace listings. Compass-v3 improves the accuracy of search, recommendations, and sentiment analysis across these formats. It interprets feedback, detects trends, and helps sellers respond faster to customer needs.

By optimizing natural language processing for multilingual contexts, Compass-v3 makes Southeast Asia E-commerce Models smarter, and the platforms will be more responsive. It gives businesses the tools to act on insights hidden in everyday language — from predicting what products will trend next month to spotting dissatisfaction before it spreads.

The Future of Southeast Asia E-commerce Models

The next phase of growth will come from precision. As Southeast Asia E-commerce Models evolve, those using domain-specific AI like Compass-v3 will outpace others. These tools allow businesses to manage complexity at scale — translating the region’s linguistic diversity into commercial advantage. For organizations looking to keep up, expertise matters. Market Research Southeast Asia, a global consulting firm, helps businesses integrate advanced AI and domain-specific models into their digital strategies. To learn how to apply these innovations to your e-commerce operations, contact Market Research Southeast Asia and explore their tailored services for Southeast Asia’s fast-moving markets.