Public-Private Partnerships (PPPs) are becoming essential tools for developing infrastructure across Southeast Asia. As the region continues to modernize, many governments are turning to PPPs to fill infrastructure gaps. They are also using Public-Private Partnerships Southeast Asia to access private financing and leverage specialized expertise. With varying levels of infrastructure development in Southeast Asia, PPPs offer a model that combines both public oversight and private sector efficiency.

Singapore: A Developed Model for Public-Private Partnerships Southeast Asia

In Southeast Asia, Singapore stands out for its highly developed infrastructure. This island city-state, focused primarily on services, has carefully structured its infrastructure to meet the demands of its population. Its transportation network, for instance, is widely regarded as one of the most advanced in the world. It is ensuring connectivity throughout the island for locals and tourists alike. The energy infrastructure also ensures reliable power supply, adding to the nation’s robust institutional environment.

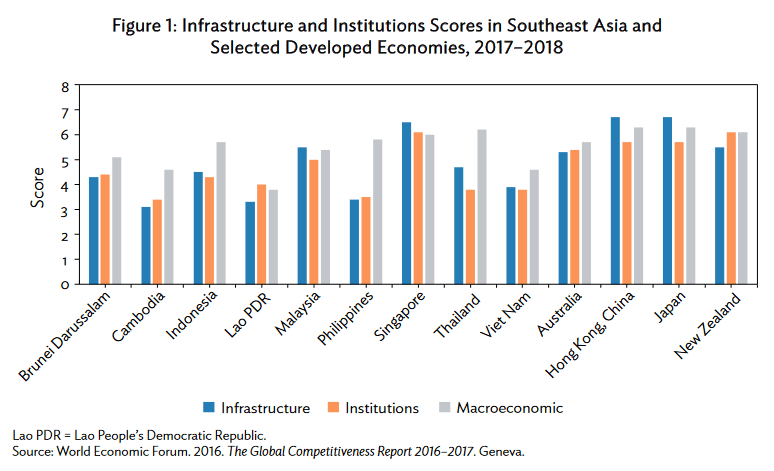

According to the World Economic Forum’s Global Competitiveness Report (2017–2018), Singapore has consistently ranked second globally in competitiveness since 2012. This ranking reflects the effectiveness of its infrastructure, bolstered by well-functioning institutions. However, in Singapore, Public-Private Partnerships Southeast Asia play a more limited role due to the country’s strong public sector funding and governance capabilities.

Indonesia: Massive Infrastructure Needs

Indonesia, on the other hand, has massive infrastructure needs. The country’s National Development Plan (2015–2019) targeted investments totaling $409 billion for infrastructure, including new airports, seaports, roads, and railways. The country aims to generate 59% of this funding through PPPs and state-owned enterprises. This highlights the critical role of Public-Private Partnerships Southeast Asia in Indonesia’s infrastructure strategy, which involves a combination of domestic and foreign companies.

The country is pursuing several significant projects under the PPP model, such as the high-speed rail line connecting Bandung and Surabaya. Moreover, Indonesia has focused on digital infrastructure, such as data centers, to attract foreign investment, especially in light of Singapore’s moratorium on data center construction.

Indonesia’s government also plans to collaborate with international financial organizations like the World Bank and the Asian Development Bank to further develop PPP frameworks. These partnerships will be essential for achieving Indonesia’s ambitious goals, especially as it works on the infrastructure for its new capital city, Nusantara.

Cambodia and the Philippines: Developing Frameworks

Countries like Cambodia and the Philippines are in earlier stages of Public-Private Partnerships Southeast Asia adoption. For example, Cambodia has worked with organizations like Partnerships for Infrastructure (P4I) to build institutional capacity. By enhancing the skills of government officials, Cambodia aims to attract more private investment and ensure that PPP projects are successful.

Similarly, the Philippines has been collaborating with international advisors to fine-tune its PPP frameworks. The Philippines PPP Center has worked closely with Australia’s Infrastructure and Commercial Advisory to share expertise. They are also helping local stakeholders manage risks and structure PPP deals more effectively. This knowledge exchange is crucial as the country seeks to expand its infrastructure projects to boost economic growth and resilience.

Challenges of Implementing Public-Private Partnerships Southeast Asia

While PPPs offer many benefits, they also come with challenges. Structuring these partnerships requires a deep understanding of financial risks, legal frameworks, and stakeholder management. According to the Asian Development Bank, scaling PPPs across Southeast Asia requires significant public sector capacity, funding, and transparent processes.

Public-Private Partnerships Southeast Asia success depends on creating an enabling environment where both public and private sectors can operate effectively. Southeast Asian governments need to ensure fair risk allocation, maintain public trust through transparency, and incorporate stakeholder voices. This is to ensure that infrastructure benefits are equitably distributed.

The Future of Public-Private Partnerships Southeast Asia

Public-Private Partnerships will continue to play a vital role in infrastructure development across Southeast Asia. Countries like Indonesia and the Philippines are working to expand their PPP frameworks, while nations like Singapore demonstrate the results of a robust institutional environment. With the right support and strategic planning, Public-Private Partnerships Southeast Asia have the potential to meet its growing infrastructure needs. This, in a way that is inclusive, sustainable, and forward-thinking.