Table of Contents

- Foreword

- Executive Summary

- ASEAN: The Thriving Market Bloc with a Vibrant Growth Story

- ASEAN’s Diverse Consumer Landscape: A Closer Look at Consumer Profiles

-

What is the future of consumption?

- Think Local, be Local: The Importance of Going Local in ASEAN

- From Bricks to Clicks: How ASEAN Retailers are Adapting to the Digital Age

- Health is Wealth: The Rise of Health and Wellness in ASEAN

- Unlocking Value: The Key to Understanding the Importance of Pricing

- The ASEAN Experience Economy: How Entertainment, Tourism, and Leisure are Driving Consumer Trends

- The Green Revolution: Invest in Sustainability now for a Better Future

- Recommendations for Attracting the ASEAN Consumer of the Future

- Concluding remarks: Investment is key to success

-

Interview

- Understanding the Vietnamese Consumer from a Marketer’s Perspective with Alexandre Sompheng

- Localising Luxury with Fanny Ponsot

- Driving the Future of Agriculture in Southeast Asia with Florian Delmas

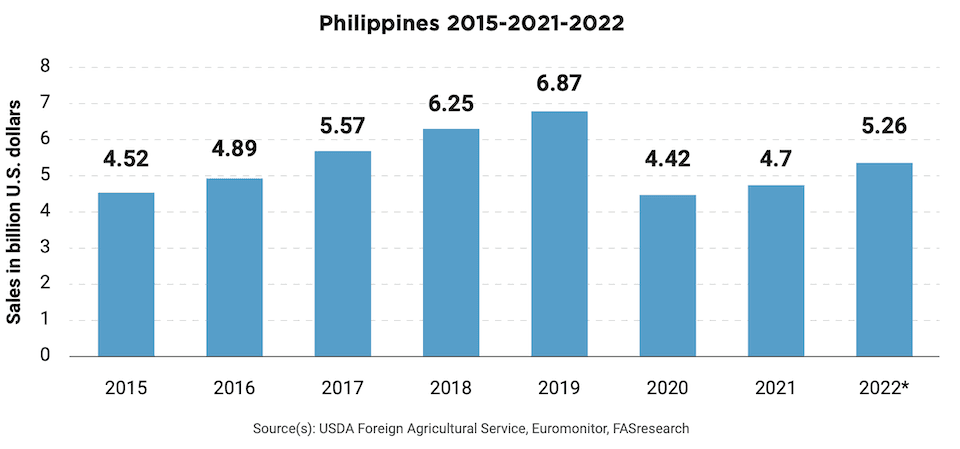

- The Clash between Local and Global Consumption Trends in the F&B Industry with Daren Ong

- Mastering the Art of Digital Success in the Age of E-commerce Giants with Fabian Teja Boegershausen

- Revolutionising the Financial Landscape: A Look at Cryptocurrencies and Fintech in ASEAN with Eric Barbier

- The Transformation of ASEAN Consumption: an Interplay between Traditions and Digital Trends with Michel Beaugier

- The Future of Finance and Investment Trends in ASEAN with Pascal Lambert

- Decathlon’s Winning Playbook: Localising Strategies and Championing Sustainability in Asia’s Diverse Markets with Frédéric Bichet

- BioMérieux: The strategy for successful healthcare development in ASEAN with Arnaud Favry

- Entertainment on the go in ASEAN with Gilles Langourieux

- Setting sustainability standards in services with Arnaud Bialecki

- Adoption of Omni Channels as a key lever for Sustainable and Agile logistics with Camille Jozon

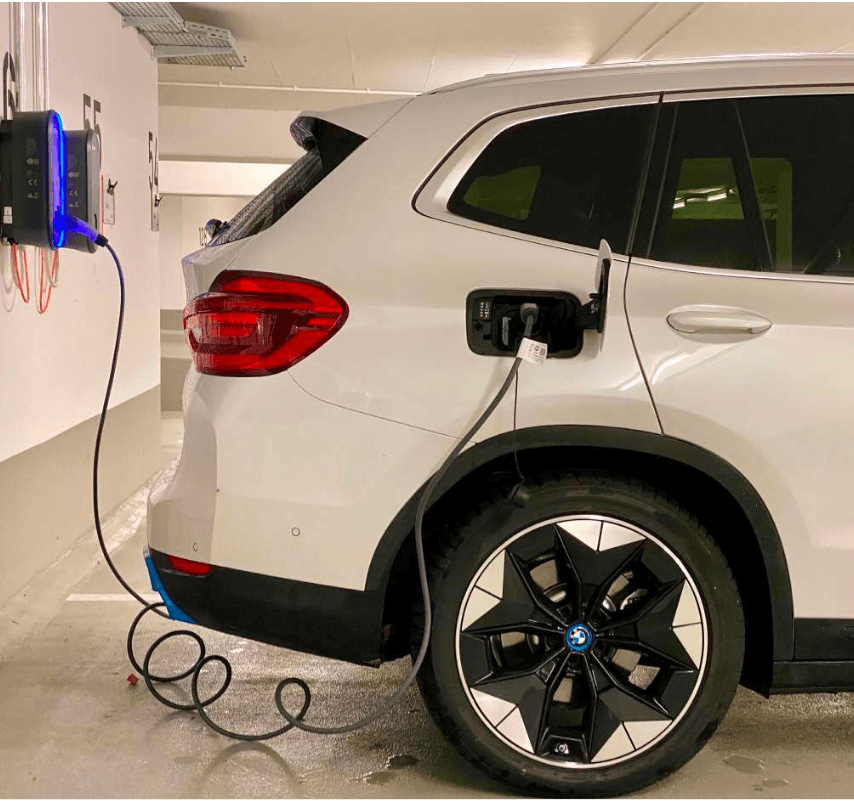

- Driving the Future of ASEAN: the Rise of Electric Vehicles and Sustainable Mobility with Damien Kerneis

- Vision for the Future: Navigating Trends and Opportunities in the ASEAN Optical Market with Jayanth Bhuvaraghan

-

Business Cases

- The Changing Role of Digital Marketing

- Grab: Driving the On-Demand Economy in Southeast Asia

- QSR: how food aggregators have disrupted the quick service restaurant market

- Creating a Retail Experience for the ASEAN Consumer: A Business Case Study

- Agoda’s Adaptive Voyage: Navigating the Post-Pandemic Hospitality Landscape in Southeast Asia

- Authors

Foreword

The Asia-Pacific region is quickly becoming strategically important in the evolving global landscape. Lying between the two most populous nations, China and India, and underpinned by a deepening economic integration manifested in numerous trade agreements.The population, concentrated largely along the coastlines, heightens the region’s sensitivity to climate change challenges and necessitates controlled urban development.

A wave of transformation is sweeping across the Asia-Pacific region, with digitisation effecting dramatic changes in every aspect of life, including consumption habits, living spaces, financial management, and communication paradigms. These vital themes formed the core of our discussions at the APAC French Trade Advisors Forum.

Within the Asia-Pacific region, ASEAN stands out as one of the world’s fastest-growing regions. Housing more than 670 million inhabitants, the majority progressively joining the middle class, ASEAN constitutes a sizeable market brimming with opportunities for our companies. Despite its diverse member nations, the region reveals several emerging trends pertaining to the future of consumer behaviour in ASEAN.

This study, undertaken within the framework of the APAC French Trade Advisors Forum and carried out by Eurogroup, comprehensively describes these trends and proffers recommendations for better engagement with these prospective markets. I wish you great success in your business within the region.

The ASEAN region is open for business and this report provides an insight into how to position yourself to take advantage.

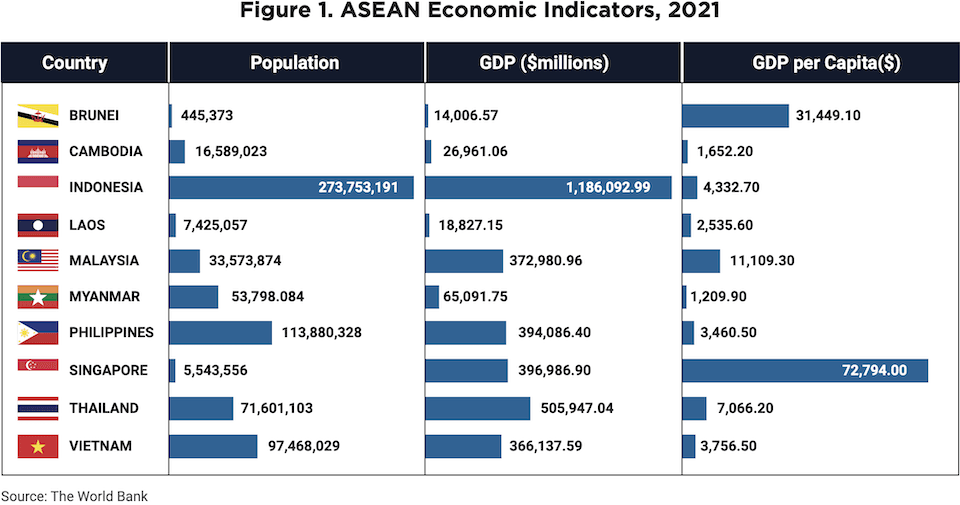

After nearly two years of stunted economic growth, lockdowns, and a gloomy global outlook, Southeast Asia is recovering strongly. Supported by a rebound in foreign investment, strong export demand, the phenomenon of revenge tourism, and benefitting from the gap left by China remaining closed for longer than the rest of the world, the ASEAN region is going from strength to strength. From the financial powerhouse of Singapore to the dynamic manufacturing and production hubs of Indonesia, Malaysia, the Philippines, and Thailand, over to the fast-growing frontier markets of Cambodia, Laos, and Myanmar, the ASEAN market is diversified, dynamic, and open for business.

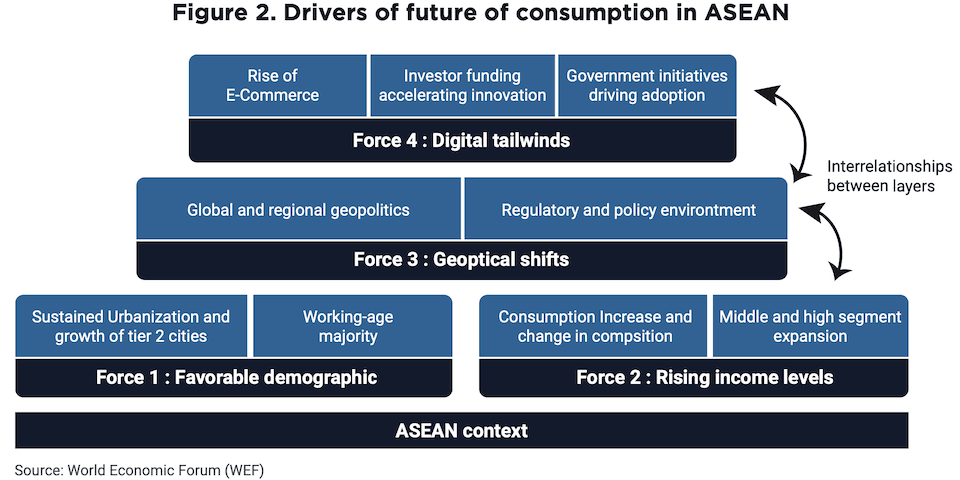

The region currently has a population of 670 million but strong domestic consumption, favourable demographics, rising income levels, geopolitical shifts, and digital advancements over the next 10 years are expected to propel ASEAN to become the world’s fourth- largest economy - behind China, the USA, and India - with growth averaging 4% a year over the next decade. The region will see 140 million new consumers and nearly 575 million internet users by 2030, which will spur growth in various sectors, including technology, and attract foreign investment. ASEAN will also be responsible for one in six households entering the world’s consuming class over the next 10 years whilst five million people will move into cities each year.

Respective governments in the region are continuing to take advantage of the nascent economic potential in their countries and implementing industrial policy, promoting and facilitating investment, and opening up to trade, both regionally and internationally. This is creating an exciting environment for foreign businesses to invest and take advantage of the exciting potential in the region.

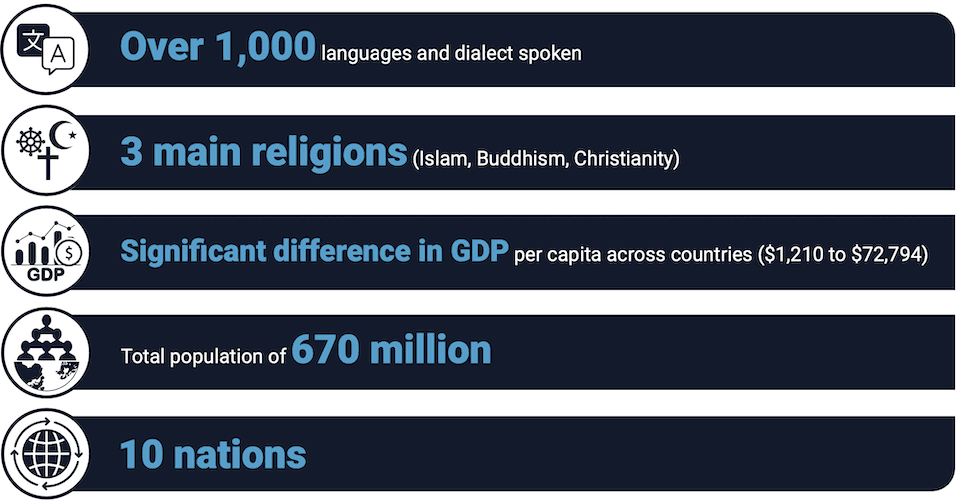

For businesses to meet this potential, this report aims to identify and analyse the consumer trends that are presenting themselves in the ten ASEAN countries and provide recommendations for foreign businesses to understand these trends. The ASEAN region is a diverse area of 670 million people, 1,000 languages and dialects, and national income levels ranging from $1,210 per person per year to $72,794. Therefore, it is important to understand that there is no single ASEAN consumer but profiles of consumers as diverse as the region itself. There is a new generation of young, digitally-connected, and globally aware consumers who are entering the market and are interested in personalised experiences, convenience, and sustainability. Growing income levels over the past decade has also seen the region home to a burgeoning middle class with disposable incomes that want premium goods but want to feel as though they are getting value. Finally, some countries have an aging population which presents unique opportunities for businesses in the healthcare, wellness, lifestyle, technology, and real estate sectors.

This research has presented us with six trends that are relevant across all industries and sectors for businesses to integrate into their planning to ensure they are well- placed to take advantage of the next decade of booming consumerism is Southeast Asia. This includes the value of being perceived as a local brand; adapting to the digital age but maintaining a physical presence; promoting health and wellness; ensuring consumers still perceive they are getting value; creating an experience for the consumer; and investing in sustainability now to be prepared for the future. To prepare for these trends, the report makes three recommendations, namely creating an integrated omni-channel approach to reach consumers both online and in-person; developing a localised approach to conducting business; and investing in sustainability now to be prepared for when this becomes a necessity.

In conclusion, Southeast Asia’s burgeoning economic prowess, coupled with its unprecedented consumer growth, is laying a fertile ground for businesses seeking to tap into its rich market diversity. By harnessing the region’s consumer trends elucidated in this report - ranging from digital engagement, experience creation, to a firm commitment towards sustainability - and deploying our three core recommendations, foreign businesses can carve a promising foothold in this dynamic region. As our research emphasises, adopting a localized approach, integrating omnichannel strategies, and investing proactively in sustainability are non-negotiable prerequisites for achieving lasting success in the ASEAN market. This report is an indispensable guide, offering invaluable insights to navigate the complexities of Southeast Asia’s vibrant economic landscape, and enabling businesses to effectively leverage the opportunities that lie within its teeming populace and expansive digital frontier. As we step into a new era of Southeast Asian consumerism, the time for action is now – to understand, adapt, and thrive amidst this exciting and transformative period of regional growth and development.

Executive Summary

The ASEAN market, an emerging economic powerhouse, boasts favourable demographics, rising incomes, and a growing consumer class. The region’s ongoing economic growth presents expanding opportunities for businesses to invest and operate in this diverse and dynamic market.

ASEAN countries have experienced strong economic growth, a rapid rebound from COVID-19, sustained demand for exports, urbanisation, digitalisation, increasing focus on sustainability, and an influx of foreign direct investment. These factors, along with shifting global value chains, make the ASEAN region a highly favourable environment for businesses and investors looking to expand.

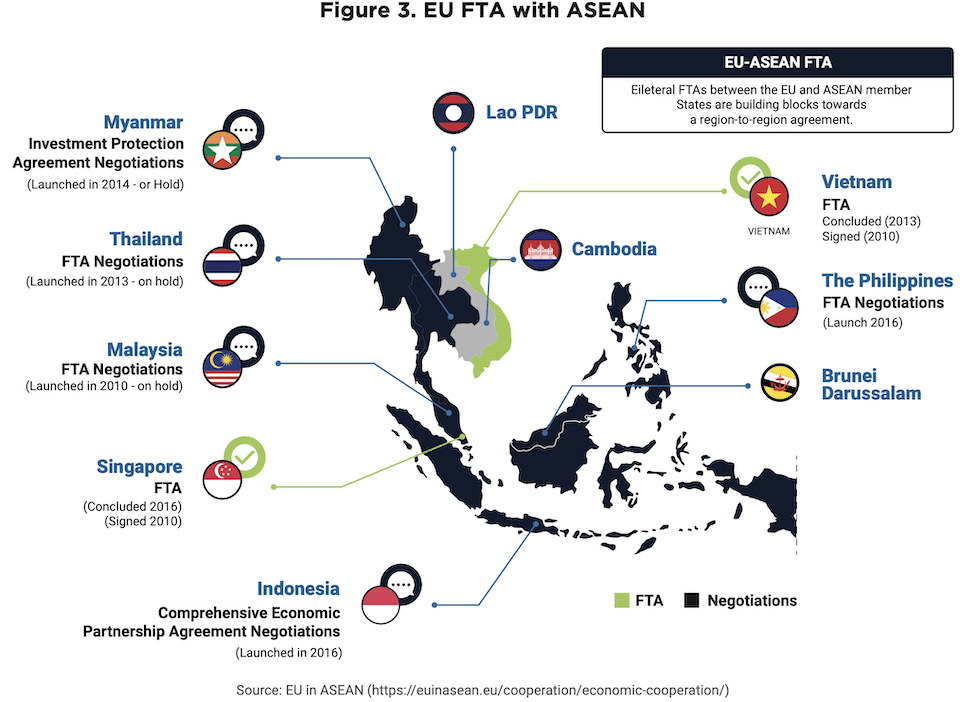

Trade and investment agreements, such as the EU-ASEAN Free Trade Agreement, the EU-Vietnam Free Trade Agreement, and the EU-Singapore Free Trade Agreement, provide preferential market access for foreign firms, including those from France. These agreements, along with collaborations in areas such as research, innovation, human capital development, and cultural exchange, create ample opportunities for businesses looking to enter or expand in the ASEAN market. To succeed in this diverse region, companies must adopt tailored strategies that cater to each country’s unique qualities and preferences.

The ASEAN region is home to a diverse range of consumer profiles that differ from country to country and even city to city. The first thing that we can point out to explain the diversity between ASEAN consumers is first the cultural differences across countries, exemplified by the different languages, religions, and ethnic groups across countries. However, consumer classes in ASEAN can be broadly classified as follows:

The six trends that have been identified in the ASEAN region as driving the future of consumption are as follows:

Think Local, Be Local: The Importance of Going Local in ASEAN

The significance of localisation was consistently emphasised as the most crucial approach for targeting the ASEAN market. This entails adapting products, marketing strategies, production, and supply chains, to brand yourself as a local firm. ASEAN comprises a diverse market with many different consumers, urbanised cities, and therefore, consumption habits but what unifies the business strategy in these markets is the importance of being branded as a local player. However, there are exceptions to this rule, especially in luxury branding, where capitalizing on foreign heritage may be advantageous.

From Bricks to Clicks: How ASEAN Retailers Are Adapting to the Digital Age

Technology and digital media are acknowledged as essential by business owners and leaders in the ASEAN region. However, developing an integrated omnichannel strategy to reach diverse consumer segments efficiently and conveniently, rather than solely focusing on the significance of technology and digital media is crucial to thriving in the diverse ASEAN market.

Health Is Wealth: The Rise of Health and Wellness in ASEAN

Paying attention to health and wellness is a trend that has accelerated during COVID-19 and is expected to stay. Consumers are increasingly demanding healthier alternatives in the products they consume. Providing a choice of healthy, organic products is going to be very important going forward.

Unlocking Value: The Key to Understanding the Importance of Pricing

With rising income levels, ASEAN consumers are expected to increase spending on indulgences and luxury goods, prioritising convenience, well-being, and personalized experiences. Despite this, price remains a top consideration for 62% of high-income consumers, indicating a continued focus on value.

The ASEAN Experience Economy: How Entertainment, Tourism, and Leisure Are Driving Consumer Trends

Increasing leisure time, growing disposable incomes, and a growing market have seen more and more people in ASEAN spend time and money on entertainment, tourism, and leisure activities. This is a quick growing market that has both been affected by and benefitted from COVID-19 and is expected to continue an upwards trajectory going forwards.

The Green Revolution: Invest in Sustainability Now for a Better Future

As sustainable practices gain momentum, it will increasingly become a requirement for ASEAN consumers when looking at brands and products. While currently below global standards, demand for sustainability is expected to surge in the coming decade with growing consumer and institutional awareness, coupled with a willingness to pay.

From these trends, the below three recommendations have been developed:

Recommendation 1

Build a Digital Space Battleplan

- Develop a triple-growth engine across traditional trade, modern trade, and e- commerce, focusing on personalised marketing through data-driven approaches and AI technologies.

- Utilise digital channels, including social media and ASEAN e-commerce platforms, to understand, segment, and engage with consumers, while incorporating local influencers and loyalty programmes.

- Create seamless, integrated omnichannel experiences that mirror the consumer journey, combining localised content with frictionless transitions between viewing and purchasing.

- Plan and strategise for the future of digital commerce, considering the synergy between store networks and digital marketplaces, and integrating emerging technologies like e-wallets and Buy Now Pay Later options.

- Prioritise aftersales engagement, customer personalisation, and loyalty through targeted promotions, rewards, and exceptional customer experiences both online and offline.

Recommendation 2

Rethink Growth Strategies With a More Localised Approach

- Understand each market’s specificities and complexities by researching and investing resources in local partnerships, supply chains, and teams.

- Leverage global expertise while adapting to local specificities, focusing on co-design, production, distribution, and financing partnerships with local companies.

- Develop a strong brand identity with a local anchor, utilising localised content and marketing approaches tailored to each country or city.

- Create value through a combination of your brand’s strengths and local partnerships to maximise market penetration and consumer engagement.

- In certain instances, leverage the power of your global brand while still localizing products and retail experiences to resonate with the target market.

Recommendation 3

Invest in Sustainability Today to Win the Consumer of Tomorrow

- Invest in sustainable development practices now to be well positioned for future demand and standards in the region.

- Educate consumers about the value and benefits of sustainable products, emphasizing long- term cost savings and environmental impact.

- Make sustainable products accessible and affordable for a wider range of consumers through strategies such as bulk purchasing, discounts, and partnerships with retailers or e-commerce platforms.

- Address price sensitivity by implementing cost-efficient and eco-friendly supply chain and production practices, from raw materials to final packaging.

- Accelerate sustainability efforts in regional and local business operations, despite challenges such as low customer willingness to pay and short-term financial trade-offs.

ASEAN: The Thriving Market Bloc With a Vibrant Growth Story

The ASEAN region is a powerhouse of business potential, boasting a strategic location, a population of 670 million, and a rapidly expanding economy.

The region’s impressive economic growth and relative regional stability has seen its 10 members plan for further integration through the ASEAN Economic Community (AEC), which has made it even easier to do business in the region by promoting the free flow of goods, services, and investments.

ASEAN is a thriving market bloc with a vibrant growth story, powered by domestic consumption, favourable demographics, rising income levels, geopolitical shifts, and digital advancements. In the next 10 years, ASEAN is expected to become the world’s fourth- largest economy - behind China, the USA, and India - with growth averaging 4% a year over the next decade. The region will see 140 million new consumers and nearly 575 million internet users by 2030, which will spur growth in various sectors, including technology, and attract foreign investment. ASEAN will also be responsible for one in six households entering the world’s consuming class. Five million people will move into cities each year, and urbanisation is projected to sustain through 2050, extending to Tier 2 and 3 cities.

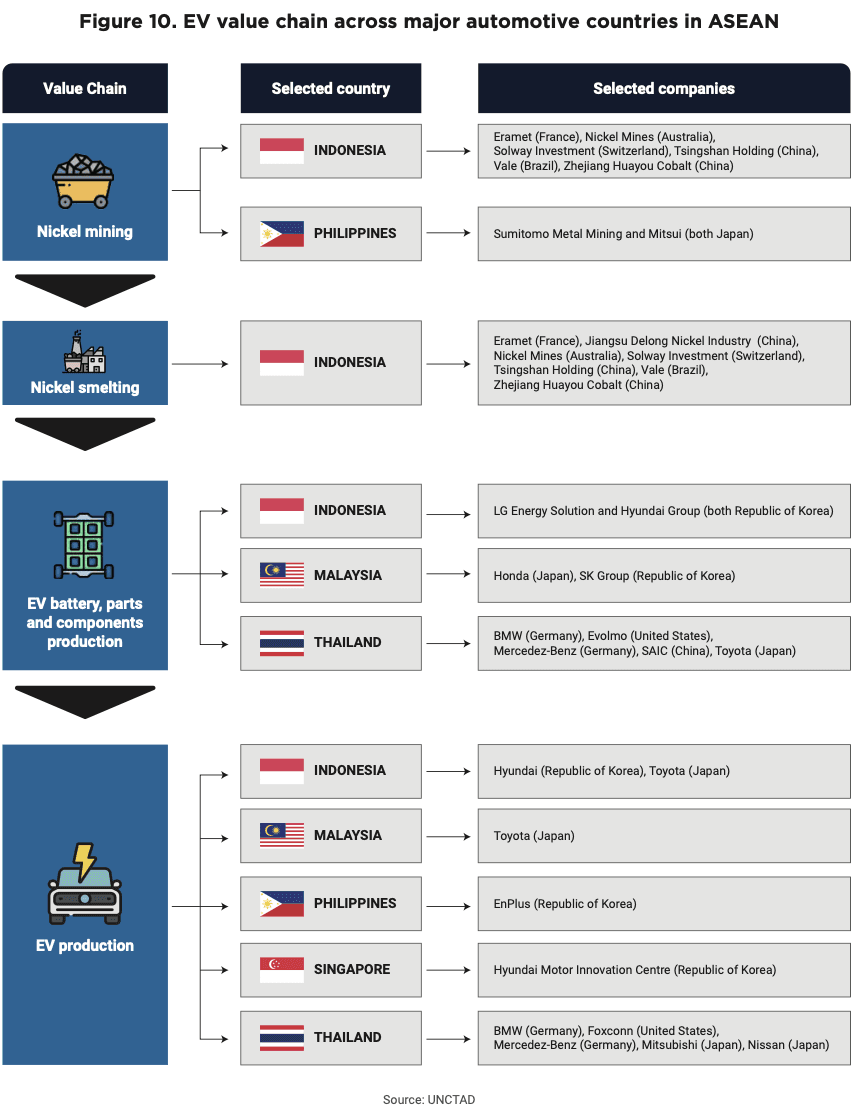

In recent years, the shift in global value chains towards the Asia-Pacific region, driven by the growth of the middle class and increasing disposable income, has further increased the potential for businesses in the ASEAN region. The region’s diverse and dynamic market presents opportunities for businesses to tap into new and growing consumer segments, and with its strategic location, ASEAN is well positioned to capture new business opportunities in the region. Despite the diversity of cultures, languages, and consumer preferences, the ASEAN consumer market presents both challenges and opportunities for businesses looking to tap into it. In conclusion, the ASEAN region presents a highly favourable environment for businesses and investors looking to expand.

“The Asian consumer has gone from a kart to a Ferrari in just 20 years, compared to 60 years in Europe”

Michel Beaugier, Managing Director at M2 Management, Head of CCE APAC

Factors driving growth in ASEAN

The ASEAN region continues to navigate the uncertainties bought about by the impact of COVID-19 and external headwinds. Estimates suggest that the pandemic has derailed GDP growth by at least two years. However, Southeast Asia’s long-term outlook remains robust, and the region is projected to outpace other markets such as the US, the EU, and China in terms of GDP growth and annual inflation rate. There are several nascent and intrinsic factors that are likely to contribute these discussed below.

The ASEAN region was able to rebound quickly from COVID-19, experiencing faster growth and lower inflation than many other regions around the world, on average.

Macro growth factors and trends working in the ASEAN regions favour are as follows:

Economic growth: ASEAN countries have been experiencing strong economic growth in recent years. According to the World Bank, ASEAN economies are projected to grow by 4.3% in 2022 and 4.9% in 2023. This economic growth is leading to rising incomes and an expanding middle class, which is driving consumption growth across a range of sectors.

Strong recovery from COVID-19: The ASEAN region was able to weather the storm of COVID-19 relatively well. Governments responded quickly with lockdowns, restrictions on movement, and vaccination programmes with good uptake. This was complemented by support packages for businesses and vulnerable communities.

Sustained demand for exports: There has been sustained global demand for ASEAN exports of manufacturing goods and commodities. There is also potential that this has been bolstered by sluggish economic activity in China that has allowed ASEAN countries to shift in the value chain and fill gaps in demand left by China.

Urbanisation: This is a major trend in ASEAN countries, with the urban population expected to reach around 60% by 2030. As urbanisation continues, consumers are becoming more accustomed to modern living standards and are increasingly spending on non-essential goods and services.

Sustainability: Climate change is an increasingly important issue in ASEAN countries, and consumers are becoming more conscious of the environmental impact of their consumption. Whilst the region lags behind global standards, demands will accelerate over the next decade as awareness of the issue increases, along with a willingness to pay.

Foreign direct investment: The inflow of FDI in ASEAN increased by 42% in 2021 compared to 2020 to $174 billion, which is higher than the pre-pandemic record level4. This rebound highlight the resilience of the region whilst also spurring innovation, development, and growth.

The ASEAN region is made up of heterogeneous markets that are held together by geography and political relations, but there is diversity in terms of economic and politicalmaturity, regulations, and cultural norms. Businesses operating in the region will need to tailor their offerings and approach to cater to these differences.

Overall consumer trends will influence the entire region, but their specific impact on different countries will depend on demographics and other macro factors. For example, Singapore will see growth driven by rising wages and a shift to high-value-added services such as FinTech. Indonesia will benefit from a growing domestic consumer class and redistribution of economic activity away from Jakarta through government policy. The Philippines will see growth from overseas remittances and services industries, and Vietnam’s growth will be driven by exports, e-commerce, and modern agribusiness. Brunei is implementing policy to support economic diversity and facilitating investment into different sectors. Frontier markets such as Cambodia, and Laos will also see growth supported by foreign investment, infrastructure spending, and efforts to climb up the value chain.

To unlock growth and target these markets, a tailored strategy is needed that considers each country’s unique qualities and preferences. While there may be commonalities between the ASEAN member states, each market will evolve differently.

Trade and Investment Agreements Relevant to Foreign Firms

As ASEAN is committed to economic integration and openness, it offers ample opportunities for French firms to access a rapidly growing market. The EU-ASEAN Free Trade Agreement, which was signed in 2019 and is yet to be ratified, aims to enhance economic cooperation between the two regions, which should benefit EU firms looking to expand their business in ASEAN.

Moreover, ASEAN member states have established individual trade and investment agreements with France, which provide preferential access to the French market and other EU markets. Some notable examples of such agreements are the EU-Vietnam Free Trade Agreement and the EU-Singapore Free Trade Agreement, which offer preferential market access for French firms. Additionally, France and ASEAN have been working to strengthen their cooperation in several areas, including research and innovation, human capital development, and cultural exchange. This presents new opportunities for French firms looking to establish partnerships and collaborations with ASEAN counterparts. Overall, there are several trade and investment agreements in ASEAN that are relevant to French firms, and the region offers a dynamic and growing market for French companies seeking to expand their business in the region.

The graphic below shows trade agreements signed by the EU. There are free-trade agreements in place with Vietnam and Singapore whilst negotiations are ongoing with five other countries.

ASEAN’s Diverse Consumer Landscape: A Closer Look at Consumer Profiles

The ASEAN region is home to a diverse range of consumer profiles that differ from country to country and even city to city. While there are some overarching themes when examining consumer profiles, it is crucial to segment consumers as much as possible to gain a more in-depth understanding of their needs and behaviours.

ASEAN Diversity

ASEAN is a diverse region with a rich cultural heritage, home to a variety of languages, religions, and traditions. There are over 670 million people living in the ten member states of ASEAN, with more than 200 different ethnic groups and over 1,000 different languages and dialects spoken. The region is also home to a wide variety of religions, including Buddhism, Islam, Christianity, Hinduism, and traditional indigenous beliefs, which are often interwoven with local cultural traditions.

Despite the diversity in ASEAN, there are also many shared cultural practices and traditions that bind the region together. For example, many ASEAN countries share a love for music, dance, and food, and traditional art forms such as batik, weaving, and carving are common across the region. The ASEAN way, which emphasises consensus- building and non-interference in each other’s domestic affairs, is also an important cultural aspect that unites the region. Additionally, the diverse cultural heritage of the region offers unique opportunities for cultural exchange and learning, with ASEAN member states often working together to promote and preserve their shared cultural heritage. Overall, the diversity of ASEAN is a defining characteristic of the region and presents a rich tapestry of cultures and traditions that offers both challenges and opportunities for the region’s people and businesses.

“It’s essential to understand that the consumers in the ASEAN region are quite diverse. The whole market cannot be regarded as a single entity. Each country has its unique cultural and economic characteristics that influence consumer behaviour. This encompasses all aspects of life. For example, in some countries, Christmas is quite widely celebrated, and brands can leverage this time of the year with promotional campaigns. However, in Vietnam for example, Christmas is just another day but new year is celebrated at the end of January, so this presents an opportunity for advertising and promotional campaigns.”

Fanny Ponsot, Managing Director, Chic APAC

Moreover, there are some overarching trends and similarities in the region that characterise these consumers, such as a high degree of price sensitivity and a desire for value for money; and changing consumer preferences due to growing affluence, the influence of globalisation, and a desire for sustainability for some consumer segments.

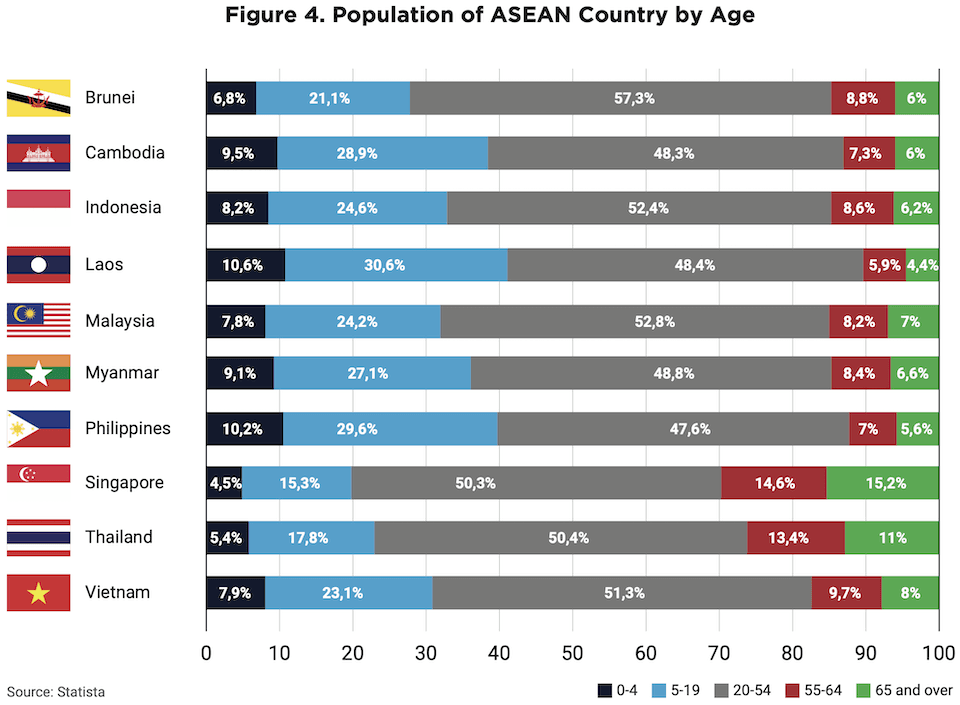

This section will summarise several different consumer archetypes before taking a more in-depth look of three major profiles and how these are expected to shape the consumption landscape going forward. These are young people, the successful middle class, the traditional consumer, and those in the elderly age bracket.

“Decathlon segments customers in ASEAN by age, taking into account the diversity of young versus older populations in each country. For example, there is a large difference in demographics between Thailand and Cambodia, where almost half of the population is younger than 24 years old. The company avoids taking a general customer approach and instead works to tailor its products and strategies to each market, recognising that consumer habits and preferences differ significantly between countries within the ASEAN region.”

Frédéric Bichet, APAC Leader, Decathlon, CCE Thailand

Description and Characteristics:

Born after 1997, this was the first generation to grow up in a predominantly digital world. This gives them access to limitless information and they tend to be more socially aware, politically engaged, and environmentally conscious than previous generations

Preferences:

Gen-Z are digital natives with a preference for online and mobile first. They value personalisation and uniqueness as well as sustainable and social responsibility.

Trend in Consumption Growth:

This is the fastest-growing segment in several ASEAN countries due to the young population and high digital engagement. Their purchasing power is expected to increase significantly in the coming years.

Best Way to Target Them:

Focus on digital channels; offer a personalised experience; demonstrate social responsibility; use authentic and relatable marketing; and prioritise mobile experiences.

Description and Characteristics:

The lifestyle of millennials in ASEAN is marked by a focus on technology, globalisation, sustainability and social responsibility, career development, and changing social and cultural values

Preferences:

Millennials in ASEAN have consumer preferences that are shaped by their lifestyle, values, and experiences, including a preference for authenticity, convenience, experiences, social responsibility, value-for-money, and digital and mobile access.

Trend in Consumption Growth:

While millennials are now reaching their thirties and forties, they are still a significant consumer class in ASEAN, with a strong influence on the region’s economy. Their spending power is expected to continue to grow, as they increasingly enter their peak earning years and become an even larger share of the consumer market. Additionally, as the youngest millennials still have a decade or more of their consumer lives ahead of them, they will continue to have a significant impact on the region’s economy and consumption trends.

Best Way to Target Them:

To effectively target millennials as a consumer class in ASEAN, brands should prioritise authenticity, convenience, unique experiences, social responsibility, and digital and mobile channels.

Description and Characteristics:

The aspiring consumer class in ASEAN refers to a demographic of consumers who are rising out of poverty and into the middle class, with an increasing level of disposable income and purchasing power. This demographic is characterised by a desire for upward social mobility, access to new technologies and products, and a preference for aspirational and prestigious brands.

Preferences:

The key theme of the aspiring class is to have it better than their parents did. They value brand prestige, quality and durability, access to technology, and convenience. For example, this class is likely to be graduating from street food to fast food once a month and are proud of their new found affluence.

Trend in Consumption Growth:

The aspirers are a growing consumer class, as more individuals in the region move out of poverty and into the middle class with increasing purchasing power and disposable income. As this demographic continues to grow and influence, it presents a significant market opportunity for businesses in ASEAN.

Best Way to Target Them:

To successfully target the aspiring consumer class in ASEAN, brands should offer aspirational and prestigious products, prioritise value, quality and durability, provide access to technology, and focus on convenience.

Description and Characteristics:

The lifestyle of the middle class in ASEAN is influenced by their rising income levels, urbanisation, and increasing exposure to global trends. They typically have stable jobs in professional or technical fields, and their income allows for a comfortable standard of living that includes owning a home, car, and other assets.

Preferences:

The middle class in ASEAN is characterised by a preference for quality and value, a growing interest in health and wellness, a focus on convenience, and a desire for upward social mobility.

Trend in Consumption Growth:

With a growing interest in upward mobility, the middle class in ASEAN is a key driver of economic growth and represents a significant market opportunity for businesses in the region.

Best Way to Target Them:

To successfully target the growing middle class in ASEAN, brands should offer quality and value, focus on health and wellness, provide convenience, demonstrate eco- friendliness, and signal upward social mobility.

Description and Characteristics:

The affluent class in ASEAN consists of individuals with a high net worth or income, and can be found in urban centres and major cities where there are typically more opportunities for high-paying jobs and access to exclusive services and amenities. However, the specific characteristics and distribution of the affluent class can vary significantly from one country to another within the diverse region of ASEAN.

Preferences:

The consumption preferences of the affluent class in ASEAN can include a preference for luxury goods and experiences, fine dining, technology, health and wellness, as well as investing in education and their children’s future.

Trend in Consumption Growth:

The affluent class in ASEAN is a growing consumer class, as the region’s economies continue to develop and create new opportunities for wealth creation.

Best Way to Target Them:

Brands can target the affluent class in ASEAN by creating luxury products and experiences, building strong brand awareness through strategic marketing campaigns, leveraging digital platforms to reach and engage with affluent consumers, and establishing strong relationships with key influencers and tastemakers in the region.

Description and Characteristics:

Rural traditionalists in ASEAN are consumers who live in rural areas, often involved in traditional industries, prioritise practicality and affordability over luxury, and may have limited access to modern technology and global trends.

Preferences:

The consumer preferences of rural traditionalists in ASEAN are practical, affordable and influenced by their traditional lifestyles, with a focus on purchasing necessary goods and services, local products, and brands with a long history.

Trend in Consumption Growth:

The rural traditionalist consumer class in ASEAN is still significant, as a significant portion of the region’s population still lives in rural areas, but their growth potential may be limited compared to the emerging affluent class in urban areas which is expanding more rapidly.

Best Way to Target Them:

To target rural traditionalists in ASEAN, brands can develop products and services that are tailored to their practical needs and traditional lifestyles, with a focus on affordability, reliability, and functionality. Brands can also engage with rural communities through local events, word-of-mouth marketing, and other traditional channels, and build trust and credibility by demonstrating a commitment to the local community and understanding their values and priorities. Finally, brands can also invest in local distribution and supply chains to reach rural consumers more effectively, and explore partnerships with local businesses and entrepreneurs to tap into the potential of rural markets.

The New Generation of Consumers: Unpacking Young People

There is a growing young, tech-savvy, well-informed population entering the workforce. This group is well-educated and are working in professional positions in both big and small cities.

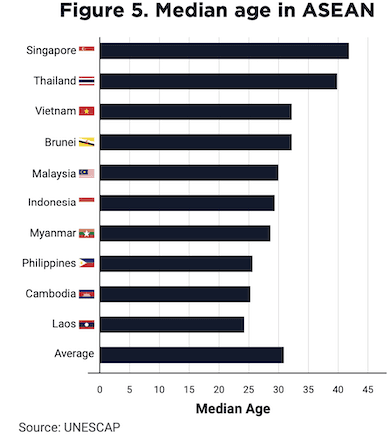

This group of consumers is increasingly urbanised whilst rising productivity in these countries is giving this group increasing disposable incomes. The median average age across all ASEAN countries is just 31.

The pandemic hit this group during a coming-of- age period in their lives and the legacy of it on their consumption patterns will be huge. This has seen them become both more cautious and more digital. The World Economic Forum (WEF) revealed that 58% of ASEAN youth consumers say lockdowns made them think more about budgeting, 56% evaluated their emergency savings and 31% want to improve their income. The WEF also says 87% of youths increased usage of digital tools during the pandemic. Indonesia and Singapore saw a strong boost in digital adoption, with over 50% of youths increasing eCommerce buying.

Interviews conducted as part of this research showed that young people prioritise experiences and convenience over ownership, and value sustainability and social responsibility. Social media influences their shopping habits, which are characterised by quick purchases, a preference for subscriptions, and seamless immediate delivery.

Brands targeting this group should focus on offering personalised and seamless experiences through technology and digital channels, while also addressing their values and preferences in terms of sustainability and social impact. This demographic is expected to continue driving growth in the region and shaping the future of consumer trends.

The New Middle: How Growing Affluence is Changing Consumerism

The ASEAN region is experiencing a boom in economic growth and income levels, creating a new affluent consumer class.

“In terms of consumption trends, people in the region tend to look for deals and prioritise spending on items they hold in high regard, like branded electronics or cars, while spending as little as possible on everyday items. This makes it challenging for premium products or sustainable options to gain widespread adoption in the market.”

Fabian Teja Boegershausen, Category Director – General Merchandise, Lazada

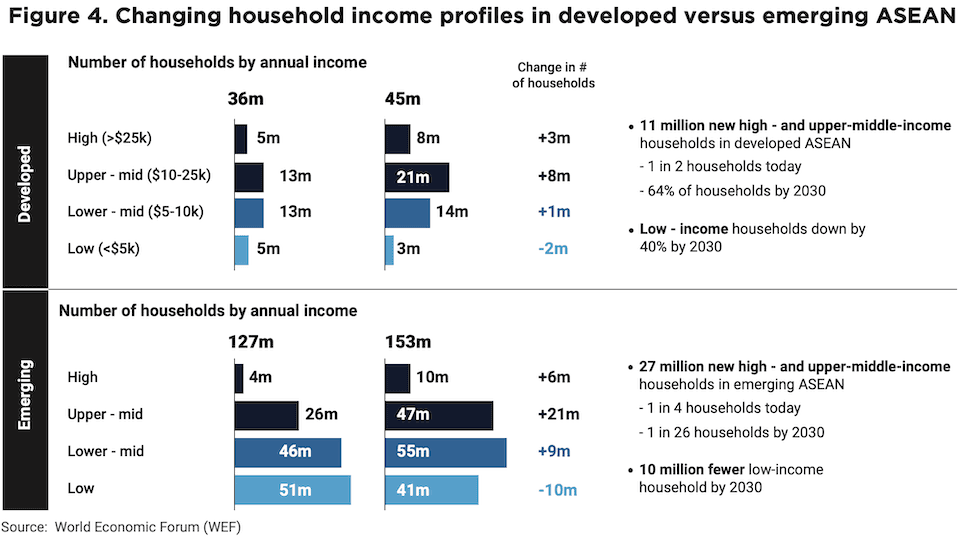

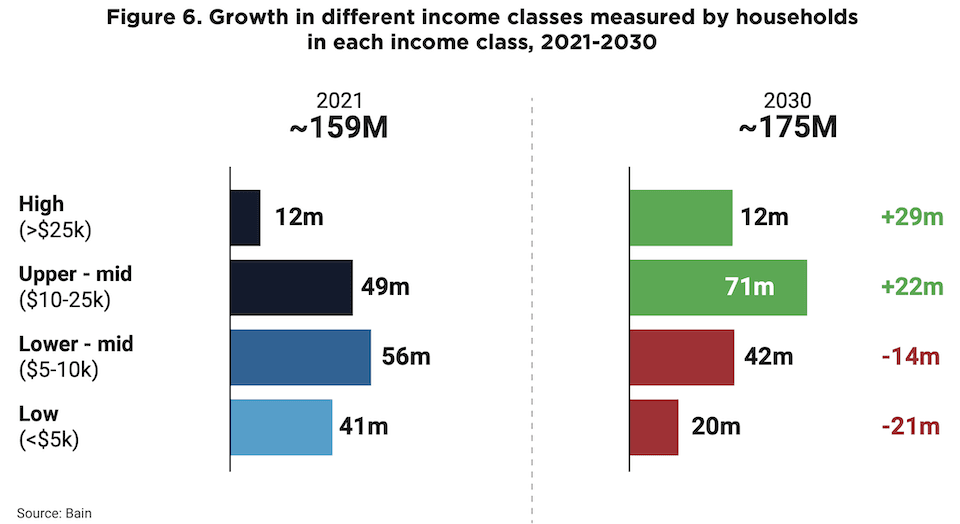

Research from the World Economic Forum (WEF) shows that. by 2030, ASEAN is expected to contribute 140 million new consumers, which represents 16% of the world’s new consumer class. The number of high- and upper-middle income households in ASEAN is expected to nearly double from 30 million to 57 million from 2019 to 2030, fuelling a boom in consumption.

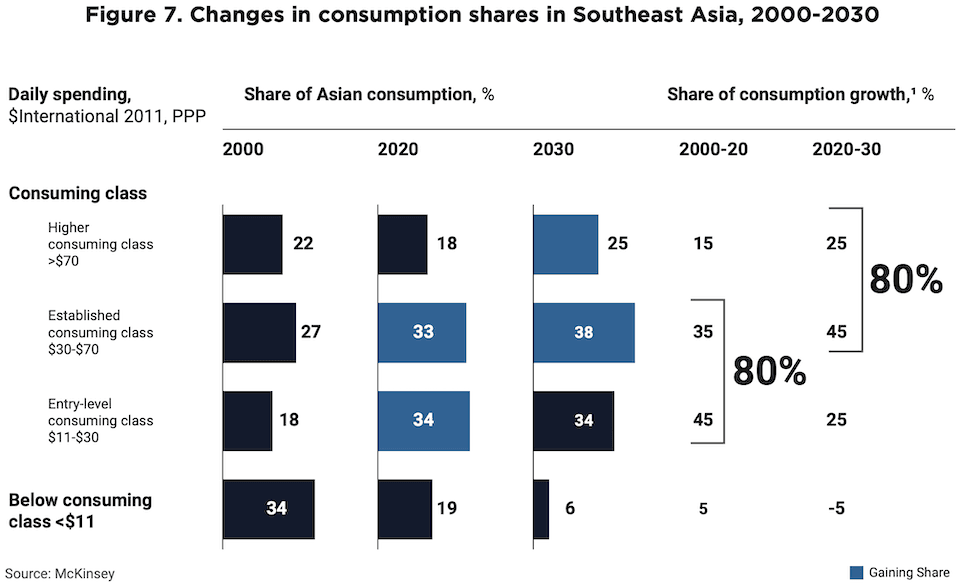

Households with incomes greater than $25,000 are expected to increase by 29 million in just nine years whilst households with incomes of less than $5,000 are expected to shrink by 21 million (Figure 6)7. The share of consumption growth is expected to shift to the two highest consumer glasses over the next 10 years (figure 7).

Whilst there is a growing class of “crazy rich Asians” that can be targeted by high-end luxury brands, these are very much in the minority. There is, however, a burgeoning middle class that have growing disposable incomes and provide a massive growth opportunity for consumer product companies. These are represented by the upper-middle class. They are a young, new generation of professionals. They are willing to spend money when they perceive they are getting value but also want to convey status. Products which convey luxury but are priced affordably are key.

Whilst the Southeast Asian region is diverse, this group shares characteristics across each country that makes them accessible to brands:

- This group of consumers tend to travel frequently, but regionally and locally, rather than to Europe or the US.

- They are found predominantly in Tier 1 and Tier 2 cities.

- They consume digital media which influences their lifestyle choices and attitudes.

This group has long existed in Singapore but are emerging in the likes of Indonesia, Malaysia, Thailand, the Philippines, and Vietnam. They are also likely to have professional jobs in international companies and will be a key driver of the future of consumption in ASEAN.

During interviews, business executives revealed that consumers were price sensitive on essential products, such as toothpaste or food for daily consumption. However, they become less price sensitive and more interested in perceived value on luxuries, such as skincare, electronics, and clothes. It is important to note that they also want quality and durability when spending extra money on an item as they are unlikely to be continually upgrading products unless they must.

To ensure customer loyalty and growth in Southeast Asia, companies should tailor their product prices to the income-consumption curve of the region, offering a price ladder for each product that targets different consumer segments and enables consumers to upgrade as they gain affluence. Brands that do not align their product prices to the upgrading pattern of consumers may lose customers to competitors as incomes rise.

To capture the opportunities presented by Southeast Asia’s affluent consumers, companies should develop a regional strategy to target them and define a journey that targets different stages of growing wealth and affluence. Ensuring premium quality products at affordable prices is key whilst also ensuring a display of uniqueness and exclusivity. Companies should use digital channels to reach the affluent consumers by establishing a strong digital presence, infiltrating private circles of sophisticated consumers, engaging with fashion bloggers and influencers to promote their brands, and targeting travellers at airport duty-free shops.

Ageless Opportunities: Marketing to the Older Generation in ASEAN

As the elderly population in ASEAN continues to grow, they are emerging as a new and significant consumer class with specific needs and preferences.

A lot is often made of favourable demographics in ASEAN countries, referring specifically to the young working age population. However, during our research, many interviewees revealed the importance of paying attention to the elderly population as well. Thailand is one of the fastest-ageing countries in the world, with a low fertility rate, long life expectancy, and large baby boomer population. The population over the age of 60 in Thailand is expected to increase from 13% in 2010 to 33%in 20409. The elderly population in ASEAN is growing rapidly, with the number of people aged 65 and over expected to triple by 2050. This Laos demographic shift presents both challenges and opportunities for businesses, as elderly consumers have different needs and preferences than younger consumers.

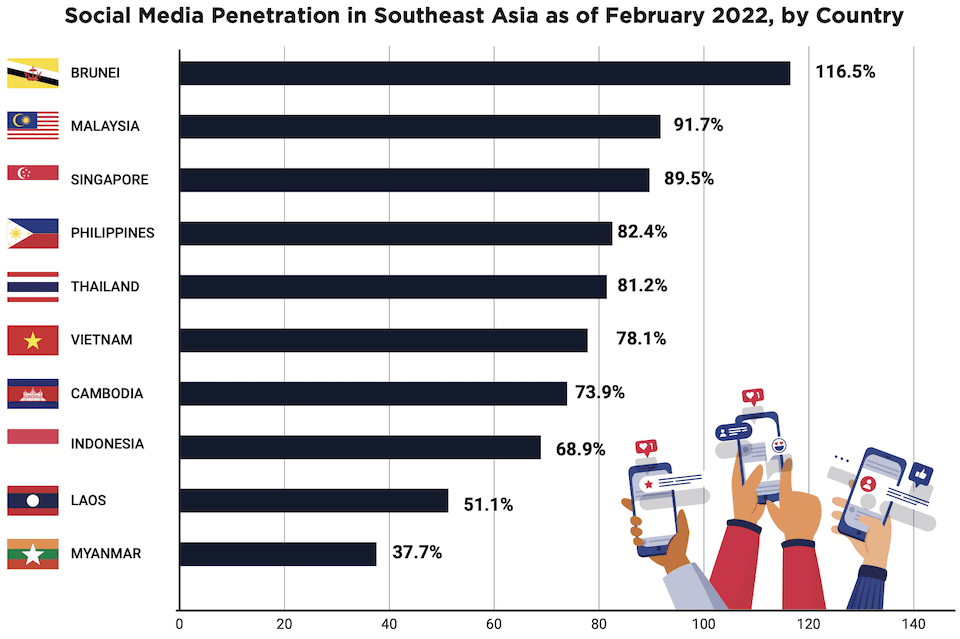

This group of consumers has become increasingly active online during the pandemic but in a different way to other groups. They are less technologically adept and prefer simplicity and convenience if they shop online. They are more likely to be on Facebook than TikTok or Instagram and, therefore, brands need to think of a social media strategy that can engage with them through this medium. However, traditional media should not be neglected either. Rather than new and unique brands or products, they tend to prefer tried and tested products where quality and value for money are synonymous. The pandemic also showed the importance of a healthy lifestyle. Walking and group classes are preferred forms of exercise whilst enriched foods are also likely to be consumed.

One key thing that has been highlighted was the importance of customer service and word of mouth. Many older people appreciate personalised attention and support, so brands that take the time to understand their needs and preferences will be more successful in building lasting relationships with this demographic. Those who do not engage with media also relied on word of mouth for opinions and companies that provide superior customer service are likely to recommend to their friends. Finally, this group is also likely to have less disposable income than the previous two groups and, therefore, are more price sensitive. Incentives, promotions, and discounts are effective ways to target this group.

As the population of seniors increases in ASEAN, several industries are expected to benefit, particularly those that cater

to the healthcare, wellness, and lifestyle needs of this demographic. One industry that is likely to see significant growth is healthcare, with an increased demand for medical services, specialised care, and home care services. Wellness and lifestyle services are also expected

to see a surge in demand, as seniors seek to maintain their health, mobility, and independence. This could include everything from fitness classes and personal training to beauty services, nutrition counselling, and travel services that cater to the needs and preferences of seniors. In addition, there is a growing demand for senior-friendly housing, including retirement homes and assisted living facilities, as well as home modification services that can make existing homes more accessible and safer for seniors.

As the population of seniors increases in ASEAN, several industries are expected to benefit, particularly those that cater

to the healthcare, wellness, and lifestyle needs of this demographic. One industry that is likely to see significant growth is healthcare, with an increased demand for medical services, specialised care, and home care services. Wellness and lifestyle services are also expected

to see a surge in demand, as seniors seek to maintain their health, mobility, and independence. This could include everything from fitness classes and personal training to beauty services, nutrition counselling, and travel services that cater to the needs and preferences of seniors. In addition, there is a growing demand for senior-friendly housing, including retirement homes and assisted living facilities, as well as home modification services that can make existing homes more accessible and safer for seniors.

Overall, the increase of seniors in ASEAN is expected to create new opportunities for businesses in the healthcare, wellness, lifestyle, technology, and real estate sectors, among others. These industries will need to adapt their products and services to meet the unique needs and preferences of this demographic, to tap into the potential of this growing market.

What Is The Future of Consumption?

Southeast Asia is experiencing a period of rapid economic growth and development, and this is causing significant shifts in consumption patterns across the region. Despite the heterogeneity and varying development phases of the ten countries in the region, there are common underlying trends that are emerging that businesses need to keep on their radar. These trends will be discussed in more detail alongside viewpoints gathered from interviews with key informants from businesses in the region.

Think Local, be Local: The Importance of Going Local in ASEAN

The significance of localisation was consistently emphasised as the most crucial approach for targeting the ASEAN market. This entails adapting products, marketing strategies, production, and supply chains, to brand yourself as a local firm. ASEAN comprises a diverse market with many different consumers, urbanised cities, and therefore, consumption habits but what unifies the business strategy in these markets is the importance of being branded as a local player. However, there are exceptions to this rule, especially in luxury branding, where capitalizing on foreign heritage may be advantageous.

Localisation entails developing local products and brands, developing local partnerships, and recognising the strength of local brands. There is a growing desire among consumers for products and services that are manufactured domestically and that reflect local cultures and traditions. As awareness of sustainability and responsible consumption continues to grow, an increasing share of ASEAN consumers are looking for products that support local communities. This trend is particularly strong in countries like Indonesia, the Philippines, and Vietnam, where traditional crafts and cultural heritage play a major role in consumer preferences.

“Decathlon places a strong emphasis on being as local as possible in its operations. The company does not communicate on its French roots, instead focusing on being local in each market it operates in.”

Frédéric Bichet, APAC Leader, Decathlon, CCE Thailand

All the while, the rise of e-commerce and digital platforms is enabling local brands to reach new audiences and expand their customer base. By leveraging digital channels, local brands can showcase their unique offerings and differentiate themselves from global competitors, while also building closer relationships with consumers. In F&B categories, and consumer goods, especially at lower price points, consumers often prefer locally made goods. In personal care in Indonesia, the top brand Rinso is global (Unilever), but the next most popular brands are local: So Klin and Daia. This preference will fuel growth for local companies, which have been steadily winning share from multinationals. In Indonesia again, the brand Wings Corp. is competing head- to-head with Unilever and P&G. Sales data in Indonesia shows that in the hot drinks sub-category, local companies have outperformed multinationals by 9% annually over the past five years.

The rise of local brands is a growing trend in ASEAN. Consumers are increasingly drawn to locally made products that reflect their culture and offer unique value. The COVID-19 pandemic has also reinforced the importance of buying local to support local economies. Local brands have successfully leveraged their local knowledge, cultural insights, and production capabilities to differentiate themselves from international brands. This trend is expected to continue in the future with the growth of the ASEAN region and e-commerce.

There are several reasons for the strength of local brands and companies:

Localisation:

Local brands

are more adept adapting to

the changing needs of local shoppers as they are more likely to have local insights and on-the-ground decision making. This enables them to quickly adapt their product offerings and marketing techniques to changing consumer profiling without bureaucratic branding requirements that might come from international head offices.

Regulation and the need for scale:

When investing in a new country, foreign brands need

to be able to do it at scale to ensure the profitability of their investment. From offering business services to setting up manufacturing bases, unless there is significant demand for scale then the costs can be prohibitive. Foreign brands also need to consider the regulatory environment and the additional cost this can bring. For example, to hire a foreign national in Thailand, four local staff are required. In Vietnam, a foreign company must pass economic needs test, or their investment will be blocked

Wings Corp, an Indonesian company, has outcompeted global giants P&G and Unilever by leveraging local brand status, understanding the domestic market, consumer preferences, and cultural nuances. Wings’ localisation strategy includes tailored products, competitive pricing, and culturally relevant marketing, which has resonated with Indonesian consumers. In contrast, P&G and Unilever’s reliance on global branding has limited their adaptability.

“Brand building plays a significant role in achieving success with a favorable return on investment throughout Southeast Asia. In Singapore, brands have the opportunity to capitalize on the entrepreneurial atmosphere and benefit from early entrepreneurship campaigns. In Vietnam, it is vital to collaborate with trade partners and gain insight into diverse consumer profiles across different regions. For instance, the northern population tends to be more ostentatious, while the southern region exhibits distinct preferences. In Cambodia, it is crucial to acknowledge the country’s multinational nature, heavily rely on wholesalers, and gain a deeper understanding of customers and their consumer preferences based on regional nationalities.”

Alexandre Sompheng, CEO, Havas Group Vietnam, CCE Vietnam

While local consumer goods brands like Indofood and Amul have achieved high market shares within their markets, they have often struggled to cross borders. However, regional Asian players such as ThaiBev, San Miguel, and Amorepacific have shifted the landscape, growing faster than the overall market by exporting products, partnering with e-commerce platforms, and developing market-specific strategies. This suggests a path for regional champions to gain market share in Southeast Asia’s consumer goods sector.

Coca-Cola’s partnership with ThaiBev in Thailand demonstrates the benefits of collaborating with strong local players, as it allowed the company to access small retail stores, reach remote areas, and gain valuable local consumer insights. Consequently, Coca-Cola increased its sales, market share, and developed locally inspired marketing campaigns in Thailand.

This presents both opportunities and challenges for businesses in the ASEAN region, as they seek to balance the desire for localisation with the need to remain competitive and innovative. In the years ahead, the trend towards localisation and local brands is likely to continue to shape the ASEAN market, with companies that can tap into this trend and deliver products and services that reflect local values and cultures well-positioned to succeed. International brands should focus on adapting their strategies to meet the unique needs and preferences of local consumers. This may include tailoring their product offerings, employing culturally relevant marketing and advertising, and building strong local distribution networks. By embracing localisation and demonstrating a deep understanding of the target market, international brands can enhance their competitiveness and effectively connect with consumers in diverse regions.

There are caveats to this. Luxury brands can leverage their heritage and history and are often bought because of the status they convey. A lot of these brands unique selling point is the global dimension, the location in which they are made and the high-quality design and production processes they use in their domestic country. Luxury brands can bolster their success, however, by localising some of their product offerings. Incorporating traditional and local designs into products sold in the Southeast Asian region can be hugely beneficial.

Creating Local Partnerships and Forging a Local Identity

“Kuala Lumpur is different from Penang, and Hanoi is different from Ho Chi Minh City. Each city must be approached differently”.

Top Executive at regional retail store chain

It is incredibly important to understand that markets across ASEAN differ from country to country and even from city to city. Tackling ASEAN as a single homogenous market is likely to lead to failure. Understanding local tastes and preferences is incredibly important and adapting the brand and product offering to this is of paramount importance. Andros, for example, sets up manufacturing hubs in each of the country in which it operates and sources local ingredients for the products in each of these countries and this was highlighted as something that is imperative for the company to strive. Localisation or the perception of being local is critical to appeal to many consumers. Incorporating and tailoring tastes and preferences from products to marketing is vital. For example, in Indonesia, 60% of urban affluent consumers and 80% of rural, older consumers prefer local brands to global brands, according to the WEF.

“One of the most important things to keep in mind is the need to understand the local culture. This is essential for building relationships with local partners and customers and developing a deeper understanding of the market and its unique challenges. For example, family is very important in Vietnam, that the respect for parents and grandparents is much higher than in western countries. and it influences consumer behaviour a lot.”

Alexandre Sompheng, CEO, Havas Group Vietnam, CCE Vietnam

Forming local partnerships in ASEAN is important because it can help companies gain access to local expertise and networks, as well as navigate local regulations and cultural differences. Local partners can provide valuable insights into local consumer preferences and market trends, which can help companies tailor their products and services to better meet local demand. Additionally, partnering with local companies can help build trust and credibility with local consumers, who may be more likely to trust and support companies that are seen as having a local presence and investment in the community. Finally, forming local partnerships can help companies mitigate the risks associated with doing business in unfamiliar and potentially challenging environments, such as navigating corruption, bureaucratic red tape, and other barriers to entry.

Key Takeaways

- Cater to local tastes and preferences: Adapting products and marketing strategies to align with local cultures and preferences is crucial for success in ASEAN markets, as consumers often have strong affinities for homegrown brands.

- Leverage local partnerships: Forming strategic collaborations with local companies provides access to valuable market insights, distribution networks, and expertise, helping international brands navigate unique market challenges and build trust with local consumers.

- Enhance competitiveness: Localising product offerings, marketing campaigns, and distribution networks enables companies to effectively compete with regional players that have a strong understanding of local consumer needs and preferences.

- Navigate fragmented markets: Recognising the diverse nature of ASEAN markets and the importance of addressing differences between countries and cities allows companies to tailor their strategies for each unique market, increasing their chances of success.

- Support local economies and communities: By sourcing local ingredients and establishing local supply chains, companies can contribute to the economic development of the regions in which they operate, fostering goodwill and building stronger relationships with local stakeholders.

“Understanding the how businesses operate in Southeast Asia is key. The markets are much more fragmented with more steps and intermediaries in the value chain. This makes business more complex and requires local partnerships who understand the market and how to approach and interact with intermediaries at the different levels in the value chain. However, it is important to understand the added value that these intermediaries bring and a strong link between all steps in the value chain is required to ensure quality control throughout the process.”

Florian Delmas, President, Andros

From Bricks to Clicks: How ASEAN Retailers are Adapting to the Digital Age

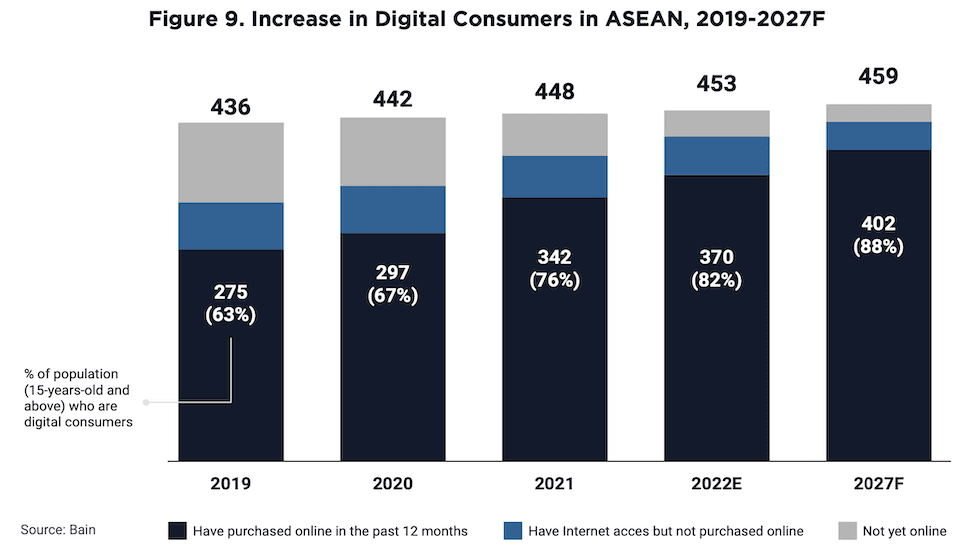

Southeast Asia’s digital economy is expected to reach • $200 billion in gross market value in 2022, three years ahead of previous expectations. Out of a population of approximately 600 million people, it is estimated that 460 million of them were internet users in 2022. Similarly, smartphone penetration is currently at 88% and is expected to reach 90% by 2026. COVID-19 has accelerated this trend and meant that everyone from Gen-Z to the elderly are accessing digital technologies for everything from consumption to entertainment.

This presents both opportunities and challenges for brands:

Brand loyalty:

Consumers are in a digital age where they are surrounded by information and products.

This has important repercussions for brands.

The availability of numerous options will intensify consumers’ tendency to switch brands and try out new products. The prevalence of digital technology and easy access to information will make it challenging for brands to retain customers. Research done by Bain and Meta showed that in 2022, 53% of consumers switched their most-purchased brand in the last 3 months whilst 65% of consumers, on average, said they would change brands if their preferred option was not available.

Omnichannel:

Omnichannel refers to a multichannel approach to sales and marketing that provides customers with a seamless and integrated

shopping experience across all available channels, including online, mobile, and in-store. This means

that customers can engage with a retailer or brand through multiple channels and have a consistent

and personalised experience regardless of which channel they use. For example, a customer might start shopping online, add items to their cart, and then choose to pick up the items in-store, or vice versa. The omnichannel approach seeks to create a unified brand experience for the customer, with a focus on convenience and accessibility across all channels.

Creating an experience:

Interviewees revealed

the importance of creating a retail experience for consumers and this needs to be both in store and online. Creating games when people join websites to win prizes has proved popular for some companies like Lazada, Shopee, and Central. Offering a personalised shopping and experience through the digital medium where consumers can see unique recommendations is also something that consumers value.

“One of the key trends I have observed in recent years is the digitalisation of life across these varied populations, with digital platforms like Lazada, Shopee, and Grab becoming integral to the everyday lives of consumers. This digitalisation trend transcends the different cultures and religions in the region, but it is essential to note that it does not equate to globalisation. People in Southeast Asia may be heavily reliant on digital platforms, but their interests and activities are not necessarily global in nature.”

Fabian Teja Boegershausen, Category Director – General Merchandise, Lazada

E-commerce: Blurring Shopping Channels

In the ASEAN region, e-commerce is still in a nascent stage compared to more mature markets elsewhere as this is a relatively new trend that has been accelerated by COVID-19 whilst logistical and distribution challenges persist. However, its potential for rapid growth is fuelled by the region’s sizable, tech-savvy youth population, which is increasingly active on social media and more likely to make online purchases. Digital platforms and online marketplaces have simplified the shopping process, providing consumers with a diverse selection of products and services at their fingertips. These platforms enable seamless shopping experiences, allowing users to search, compare prices, and purchase items from the comfort of their homes.

The wealth of information available on digital platforms, including customer reviews and ratings, empowers consumers to make informed decisions. Furthermore, access to a broader range of sellers and vendors affords them greater choice and competitive pricing. The COVID-19 pandemic accelerated e-commerce adoption among consumers of all segments. However, challenges persist in areas such as logistics, product quality assurance, and payments.

“French companies looking to develop in ASEAN should consider the importance of e-commerce alongside brick-and-mortar stores. This approach may clash with traditional models of consumption and development, but it is crucial for companies to adapt to the changing market. Developing hybrid brands that allow for online orders in- store has not been very successful, so companies should consider alternative options, such as brick and mortar stores functioning primarily as showrooms with most orders placed online”

Michel Beaugier, Managing Director at M2 Management, Head of CCE APAC

As e-commerce and omnichannel retail strategies evolve post-COVID, the distinction between online and offline channels is becoming increasingly blurred. Currently, ASEAN consumers tend to research prices online but prefer making purchases in physical stores, valuing the tactile experience and in-person shopping atmosphere. Online shopping is favoured primarily for its convenience and price comparison capabilities.

By 2030, the boundaries between discovery and transaction channels in the region are expected to blur further as social media, e-commerce, and everyday apps integrate more entertainment and social features. This convergence will transform the shopping landscape, enhancing the seamless integration of online and offline channels in ASEAN’s omnichannel retail environment.

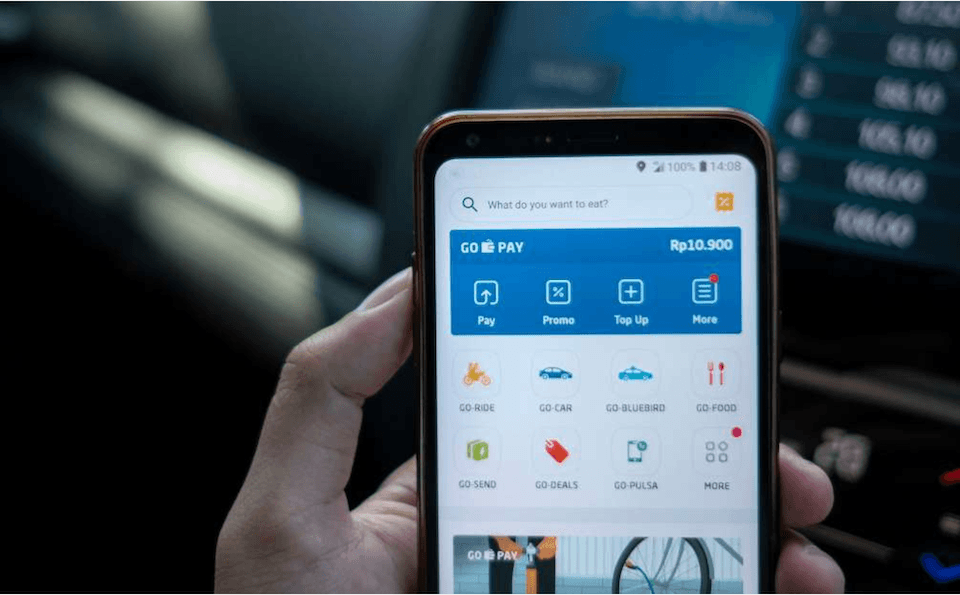

The platform economy

The platform economy has emerged as a significant and rapidly growing sector in the ASEAN region. The platform economy refers to the digital platforms that enable the exchange of goods, services, and information between consumers and providers. This includes well-known platforms such as Grab, Gojek, and Lazada, which provide services ranging from ride-hailing and food delivery to e-commerce, and financial services. The rise of the platform economy in ASEAN is driven by several factors, including increasing smartphone penetration and internet connectivity, growing demand for convenience and efficiency, and a large and youthful population.

As the platform economy continues to grow, it is transforming the way business is conducted in the ASEAN region and providing new opportunities for entrepreneurship, innovation, and economic growth. However, it also presents challenges related to regulation, competition, and consumer protection that need to be addressed to ensure the benefits of the platform economy are shared widely and sustainably.

“Marketplace seamlessness is key in the region. As mentioned previously, customers expect a smooth payment journey when making any purchase. Payment is a key consideration in any B2C exchange. Foreign brands need to understand the importance of tailoring their platforms to the local payment needs, brands must also accept a trade off in terms of look and feel when engaging with local shopping platforms such as Shopee or Lazada. Payment being the last step of the conversion funnel it is key to take it into account when operating in ASEAN countries.”

Eric Barbier, CEO, Triple-A, CCE Singapore

This technology will open several major opportunities, including:

- Mobile banking: Regulation, liquidity, infrastructure, and liquidity mean that financial services are still developing in some ASEAN countries. However, digital payment methods with lower entry requirements have the potential to provide quick access to previously underserved communities, especially given the large share of the population what still does not have a bank account. Mobile payments and “buy now pay later” opens the market to a whole new demographic that otherwise would not have access to financial facilities.

- Emerging business models including subscriptions, renting, and sharing: As Gen-Z and millennials take the lead as the prominent consumer class, businesses must adapt to new consumption patterns and offer a more extensive and adaptable range of options. Alongside catering to these customer segments, rental and sharing models will provide an avenue for businesses to pursue a more sustainable supply chain.

Key Takeaways

- Embracing digital transformation and leveraging online channels: The pandemic has accelerated the adoption of digital technologies, such as social media and e-commerce. Brands must keep pace with these changes, capitalising on digital platforms to create awareness, engage consumers, and drive sales in the ASEAN market.

- Adopting data-driven strategies and enhancing digital customer experience: By leveraging data and analytics, brands can better understand customer preferences and tailor marketing campaigns. Additionally, they should ensure a seamless online customer experience by optimising websites, mobile apps, and offering secure and convenient payment options.

- Engaging with local communities and nurturing digital partnerships: Brands should actively engage with local communities on digital platforms and collaborate with local digital platforms, startups, and partners to expand their reach and adapt to the digital landscape in ASEAN countries.

- Exploring new digital business models: As the digital landscape evolves, brands should explore emerging business models, such as subscription services, online renting and sharing platforms, and virtual experiences, to stay relevant and competitive in the digital age.

- Monitoring digital trends and staying agile: In the fast-paced digital age, brands need to stay informed about the latest trends, technologies, and consumer preferences, adapting their strategies accordingly to maintain a competitive edge in the ASEAN market.

Health is Wealth: The Rise of Health and Wellness in ASEAN

The rise of sustainability and health as consumer trends in ASEAN is having a significant impact on retail and lifestyle habits. As awareness of environmental and health issues continues to grow, many ASEAN consumers are looking for products that are aligned with their values. This was frequently highlighted during interviews with one interviewee noticing that consumers were willing to pay 30% more for organic products. While the trend towards sustainability and health offers new avenues for growth and innovation, it also conflicts with some deeply rooted traditional modes of consumption, as well as the “status-symbol” of some consumption patterns.

In response to this trend, ASEAN consumers are increasingly aware of the environmental impact of their purchasing decisions and are seeking out products that are eco-friendly, sustainably made, and locally sourced, while also showing an interest in health and wellness products. However, price sensitivity remains a significant consideration for ASEAN consumers, and companies that can offer sustainable and healthy products at an affordable price are likely to succeed in this market.

This includes a growing interest in locally made products to reduce the carbon footprint of transportation, and alternatives to single-use plastics such as cloth bags or biodegradable packaging. At the same time, ASEAN consumers are also becoming more interested in health and wellness, including a rising demand for organic and natural products, as well as those that are fortified with vitamins and minerals and free from harmful chemicals and additives. With a growing number of consumers willing to pay a premium for sustainable and healthy products, companies that can demonstrate their commitment to these values stand to benefit in the long term.

Key Takeaways

- Health-conscious consumers: The COVID-19 pandemic has accelerated the demand for healthier alternatives, with consumers in ASEAN looking for products that promote health and wellness.

- Sustainable and eco-friendly products: ASEAN consumers are increasingly aware of the environmental impact of their purchases and are seeking products that are sustainable, locally sourced, and have minimal negative impact on the environment.

- Price sensitivity: While consumers are willing to pay more for organic and eco- friendly products, affordability remains a key consideration. Companies offering sustainable and healthy products at competitive prices are more likely to succeed in the market.

- Interest in local products: Consumers in ASEAN are showing a preference for locally made products to reduce carbon footprints and support local businesses.

- Diverse preferences in sports and wellness activities: Trends in wellness and sports vary across the region, with running, outdoor activities, water sports, fitness, and niche sports gaining popularity. Companies should adapt their strategies and product offerings to cater to these emerging trends.

Unlocking Value: The Key to Understanding the Importance of Pricing

The ASEAN region is home to a large and diverse consumer market, with varying levels of income and purchasing power. As a result, the trend towards value and convenience in ASEAN retail is driven not only by price sensitivity but also by a willingness to indulge if consumers feel they are getting value for their money. The focus on value and convenience reflects changing consumer needs and preferences, as well as the growing influence of e-commerce and mobile technology.

ASEAN consumers are increasingly seeking out products and services that offer good value for their money, whether that means getting the most bang for their buck or being willing to pay a premium for products that are high-quality, convenient, and reliable. This includes a focus on price transparency, with consumers looking for clear and consistent pricing across different channels and platforms. At the same time, ASEAN consumers are also demanding greater convenience in their shopping experiences, whether that means faster delivery times, seamless online purchasing, or easy-to-use mobile apps. With consumers increasingly expecting both value and convenience in their retail experiences, companies that can deliver on these expectations are likely to succeed in the ASEAN market.

Competing with local players also becomes more difficult in this sense. Those who have lower input costs as they are located in the market in which they are selling and understand the importance of price sensitivity, especially at lower price points are likely to succeed. The two ways for foreign brands to compete in this area are either working at scale or forging local partnerships. Using foreign expertise in things like technical expertise, or branding expertise combined with local expertise in marketing can help breed pricing success.

Key Takeaways

- Rising income levels in ASEAN lead to increased spending on indulgences and luxury goods, with consumers prioritising convenience, well-being, and personalised experiences while still focusing on value.

- The diverse consumer market in ASEAN drives the trend towards value and convenience, influenced by the growing impact of e-commerce and mobile technology.

- ASEAN consumers seek products and services offering good value for money, including price transparency and consistent pricing across channels and platforms.

- Convenience in shopping experiences is increasingly important for ASEAN consumers, with expectations for faster delivery times, seamless online purchasing, and user-friendly mobile apps.

- To compete with local players, foreign brands should leverage scale or form local partnerships, combining foreign expertise in technical or branding aspects with local knowledge in marketing and pricing.

The ASEAN Experience Economy: How Entertainment, Tourism, and Leisure are Driving Consumer Trends

The ASEAN experience economy, which encompasses entertainment, tourism, and leisure, is a growing trend in the region, as more consumers seek out memorable and enjoyable experiences as part of their daily lives. This trend is being driven by several factors, including rising incomes, changing consumer preferences, and a growing interest in experiential travel and tourism.

Tourism and Leisure

The ASEAN region has seen remarkable growth in its leisure and tourism industries, driven by the development of a more robust tourism infrastructure, an increasingly diverse array of entertainment options, and evolving consumer preferences. This trend is creating a multitude of opportunities for businesses in various sectors, including entertainment, tourism, food and beverage, and retail. A deeper understanding of the underlying factors and quantitative data helps elucidate the expansion of this consumer trend in the ASEAN region.

According to a report by the World Travel and Tourism Council (WTTC), the ASEAN region witnessed a combined annual growth rate of 4.4% in travel and tourism’s direct contribution to GDP between 2016 and 2021. This growth can be attributed to the increased availability of leisure and entertainment options such as theme parks, attractions, sporting events, and music festivals. This trend is expected to continue further, driven by the growth of “revenge tourism” whereby those who missed out on travel during the pandemic are making up for lost time. According to a report by McKinsey & Company, the Southeast Asia region is expected to see a growth rate of 5.5% in the travel and tourism industry from 2019 to 2029.

Luxury and premium experiences are also gaining traction in the region. A study by Bain & Company found that the luxury goods market in Southeast Asia experienced an annual growth rate of 6% between 2015 and 2021. This growth is supported by the expanding middle and upper classes who are seeking exclusive and sophisticated experiences, often fuelled by the desire for social recognition and personal indulgence.

Sustainability and eco-friendliness are becoming increasingly important factors for consumers in the ASEAN region. This has led to the emergence of sustainable tourism and eco-tourism as popular consumer choices. For example, the number of eco-tourism arrivals in the region has grown by 10% annually since 2018, indicating a strong preference for responsible travel experiences that benefit the environment and local communities.

Entertainment

The entertainment landscape in the ASEAN region is undergoing a significant transformation as digital platforms and virtual experiences gain prominence, particularly among younger consumers who are increasingly reliant on technology for accessing leisure activities. This shift is reshaping the entertainment, tourism, and leisure sectors, with businesses needing to strike a balance between physical experiences and the convenience of digital alternatives. Key factors driving this trend include innovation, personalization, sustainability, and responsible tourism.

The rapid growth of digital platforms has significantly impacted the entertainment sector. According to Statista, the number of internet users in Southeast Asia increased from 260 million in 2015 to an estimated 400 million in 2021. This growth has led to a surge in the consumption of digital entertainment content. For example, the average monthly streaming hours per user in the region increased by 60% between 2019 and 2021, reflecting the growing demand for online content.

In response to this trend, businesses in the entertainment, tourism, and leisure sectors are focusing on innovative and personalized experiences that leverage digital platforms. A PwC report highlights that virtual reality (VR) and augmented reality (AR) technologies are expected to play a significant role in enhancing consumer experiences. In the ASEAN region, the market size for VR and AR was estimated to be worth around $1.7 billion in 2021, with a projected compound annual growth rate (CAGR) of 43% from 2021 to 2026.