Southeast Asia is experiencing a surge in infrastructure development. This is driven by growing investment in transportation, energy, and water management projects. The region continues to enhance connectivity and stimulate economic growth, with the market is projected to reach $209.3 billion by the end of 2023. Accompanying the number is a compound annual growth rate (CAGR) of 4.7% from 2023 to 2026. This Infrastructure Development Southeast Asia growth is not just vital for individual nations but also for the entire region.

Let’s delver deeper into the projects that aim to foster regional collaboration and long-term prosperity!

Regional Collaboration through ASEAN Connectivity

The ASEAN Connectivity Master Plan 2025 plays a crucial role in Southeast Asia’s infrastructure development efforts. It emphasizes cross-border projects and sustainable infrastructure solutions. The estimated annual investment requirement is of $60 billion.

This master plan seeks to strengthen economic ties among Southeast Asia member states. Countries can enhance transportation networks, energy grids, and telecommunications across borders. By improving connectivity, countries in Southeast Asia are unlocking new opportunities for trade, investment, and tourism.

Bridging the Infrastructure Financing Gap

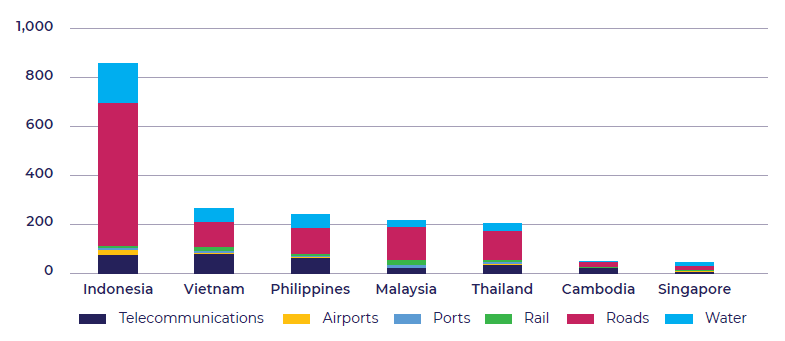

While the prospects for growth are promising, the financing needed to meet Southeast Asia’s infrastructure demands presents a challenge. The Asian Development Bank (ADB) estimates that the region will require between $184 billion and $210 billion annually for infrastructure projects from 2016 to 2030.

However, the region faces an infrastructure investment gap of around $102 billion, equivalent to 4.1% of GDP. Public-Private Partnerships (PPP) are increasingly being utilized to bridge this financing gap. They offer a viable solution to support major infrastructure initiatives.

Key Infrastructure Projects Driving Growth

In this section we can see several ambitious infrastructure projects that are propelling the region forward. They significantly contributing to economic growth and development:

- Kuala Lumpur-Singapore High-Speed Rail: One of the most prominent projects is the Kuala Lumpur-Singapore High-Speed Rail, expected to reduce travel time between the two cities to just 90 minutes. With an estimated cost of $17 billion, this project is designed to enhance regional connectivity, boost tourism, and stimulate economic activities across both Malaysia and Singapore.

- Indonesia’s National Strategic Projects: Indonesia is undertaking 222 national strategic projects, including toll roads, airports, and power plants, with a total investment of approximately $400 billion. These projects aim to create millions of jobs while contributing to Indonesia’s economic expansion.

- Vietnam’s North-South Expressway: Vietnam is also making significant strides in its infrastructure development with the North-South Expressway, a project valued at $5.4 billion. Spanning over 1,800 kilometers, this expressway will improve transportation efficiency and promote economic growth across the country.

- Philippines’ Build, Build, Build Program: The Philippine government’s “Build, Build, Build” program has allocated $35 billion for essential infrastructure projects such as roads, bridges, and airports. This initiative seeks to close the infrastructure gap and accelerate the nation’s economic development.

Infrastructure Development Southeast Asia is a critical driver of regional economic growth and cooperation. With ambitious projects in big countries like Malaysia, Indonesia, and Vietnam, the region is set for a transformative period. However, addressing the infrastructure investment gap through innovative financing solutions, such as Public-Private Partnerships, will be key to achieving long-term growth and sustainability.