Southeast Asia (SEA) is experiencing rapid economic growth, urbanization, and an increasing demand for infrastructure, from roads and airports to renewable energy facilities. The region’s countries, including Indonesia, the Philippines, and Vietnam, are investing heavily in large-scale infrastructure projects to keep pace with this growth. However, securing adequate Southeast Asia Construction Project Financing remains a challenge. This is especially true as traditional funding sources fall short of the region’s substantial needs. With an estimated $2.8 to $3.1 trillion required by 2030, innovative solutions in both public and private financing sectors are essential to bridge the gap.

The Need for Enhanced Infrastructure

Infrastructure investment is crucial for economic prosperity in SEA. Without sufficient spending, countries risk slowing growth and increased deficits. Currently, public funds account for up to 92% of SEA’s infrastructure financing. However, tight budgets and the need for funds in other areas, like food security and social protection, have limited the public sector’s capacity.

This has caused a widening Southeast Asia Construction Project Financing gap between what is needed and what governments can actually spend. Therefore, attracting private investment has become an essential part of filling this financing void.

Public Funding Limitations in Southeast Asia Construction Project Financing

Many SEA governments have historically relied on public funds for infrastructure projects, yet these resources are often stretched thin. SEA’s public sector budget pressures, including rising energy prices and economic uncertainties, have limited infrastructure spending further. Infrastructure projects in Southeast Asia Construction Project Financing require high upfront capital. They also need long development times and present risks that deter many private investors.

Furthermore, there are political instability, weak regulatory oversight, and the bad perception to worry about. This bad perception states that infrastructure is a government responsibility, so projects that need private funding might have left private investors hesitant.

For example, the Development Bank of the Philippines (DBP) has recently funded road improvements and flood management projects. However, even large, state-backed banks cannot keep up with the high demand for infrastructure investments. These kind of Southeast Asia Construction Project Financing require diversified funding sources. This is particularly as foreign direct investment (FDI) flows into SEA are relatively low, accounting for only 11% of global FDI. The scarcity underscores the need for innovative financing mechanisms that involve private and foreign investors.

Private Funding Opportunities in Southeast Asia Construction Project Financing

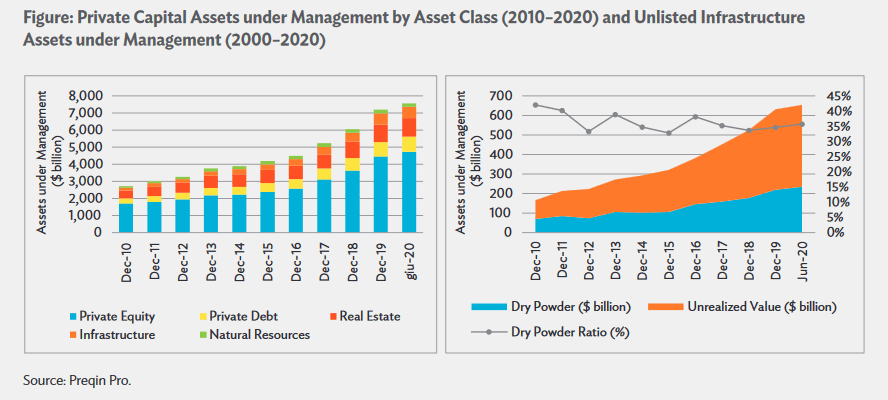

With public funds limited, SEA governments are turning to private investors to help close the financing gap. Private capital offers substantial advantages: infrastructure projects generally provide stable, inflation-resistant returns and help diversify investors’ portfolios. Institutional investors like pension funds, insurance companies, and sovereign wealth funds could fill a significant portion of the financing gap, especially through long-term bonds or by purchasing infrastructure-related assets.

For example, private funding could cover significant infrastructure upgrades in green energy, where projects like the Philippines’ offshore wind farms or Indonesia’s bio-CNG plants align with global sustainability goals. These projects are attractive to investors as they can be structured with long-term, low-risk returns, ideal for institutions with a cautious risk profile.

The Road Ahead for Sustainable Infrastructure

Looking ahead, SEA is poised for substantial growth in infrastructure development. The demand for sustainable, resilient infrastructure will only increase as the region faces environmental challenges and aims to meet international sustainable development goals. Projects across transportation, energy, urban infrastructure, and telecommunications are advancing rapidly. The increased need for infrastructure improvements makes it clear that innovative financing—especially through public-private partnerships and institution-led funds—will be critical.

By creating an environment that encourages private investment, ensuring robust regulatory frameworks, and aligning projects with investor expectations, SEA nations can take meaningful steps toward closing the financing gap. Embracing both Southeast Asia Construction Project Financing options will enable the region to realize its economic potential while building the infrastructure needed for sustainable growth.